Cryptocurrencies are nonetheless feeling the aftershocks of final week after the third-largest crypto alternate FTX imploded and later filed for chapter.

The corporate noticed liquidity dry up after an explosive report by CoinDesk that questioned how steady the empire was, leading to prospects demanding withdrawals. The saga has brought about huge monetary losses and doable prison investigations.

The most important cryptocurrency Bitcoin plunged about 65 per cent this 12 months and was buying and selling at round $16,500 (€17,000) on Monday. Different altcoins corresponding to Ethereum have adopted go well with and seen a drop of as much as 30 per cent within the final week.

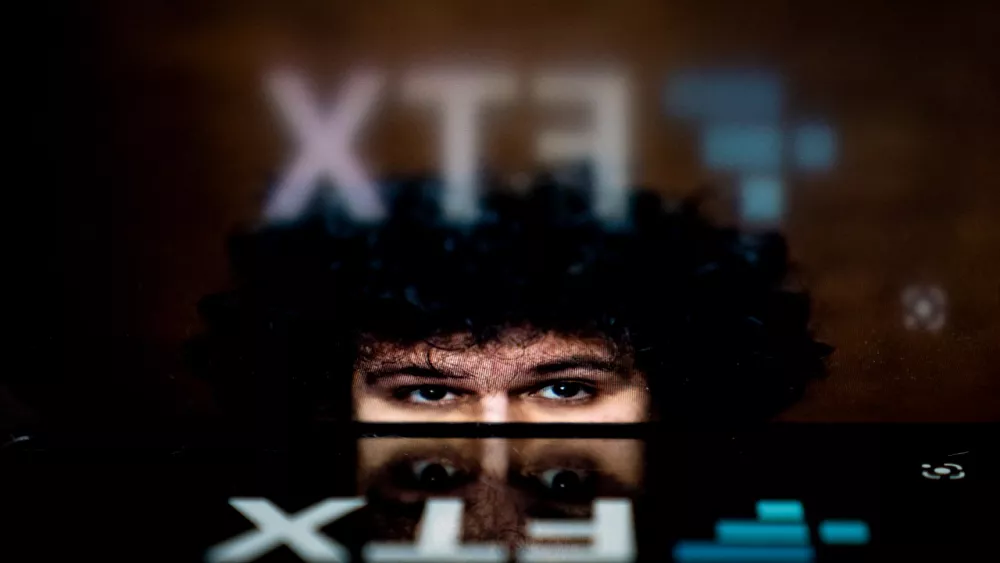

The persevering with cryptocurrency worth tumble comes after FTX filed for chapter on Friday and as FTX’s 30-year-old CEO and founder Sam Bankman-Fried, recognized by his initials SBF, resigned.

The saga has highlighted a unstable market and sparked requires tighter regulation, which some within the trade have welcomed.

“We now have seen prior to now week issues go loopy within the trade, so we do want some laws, we do want to do that correctly,” stated Changpeng Zhao, also referred to as CZ, chief government of the most important crypto alternate Binance.

Talking on Friday at a convention in Indonesia, he added that evaluating the present crypto turmoil to the 2008 monetary disaster is “in all probability an correct analogy”.

Binance has been a serious participant within the FTX turmoil. Zhao stated final week that his firm signed a letter of intent to purchase FTX however then reversed his choice as FTX’s points have been “past our [Binance’s] management”.

“On account of company due diligence, in addition to the most recent information reviews concerning mishandled buyer funds and alleged US company investigations, now we have determined that we are going to not pursue the potential acquisition of FTX.com”.

Zhao additionally introduced on Monday that Binance is establishing an trade restoration fund to assist rebuild the trade, however particulars in the intervening time are scarce.

What will we find out about FTX?

FTX was initially primarily based in Hong Kong however was later delivered to the Bahamas by Bankman-Fried, who was thought to be one of many cryptocurrency saviours after serving to different corporations that confronted issue throughout this so-called “crypto winter,” most notably Voyager Digital which failed after it had a stake in Terra.

Bankman-Fried was price about $26 billion (€25.3 billion) after he launched his crypto buying and selling agency Alameda Analysis in 2017 and two years later launched the crypto alternate FTX.

However latest occasions have seen 94 per cent of his internet price worn out in a single day.

The report by CoinDesk discovered that regardless of being separate corporations, Alameda’s property have been principally tied up in FTT, the coin of FTX. Regardless of nothing truly being improper with that, fears round FTX’s liquidity arose.

FTX is backed by many high-profile traders corresponding to SoftBank Imaginative and prescient Fund, Tiger International, Sequoia Capital, and BlackRock.

FTX had additionally appointed celeb Tom Brady as a model ambassador after which invited his spouse Gisele Bundchen as an advisor for environmental issues.

Investigations and a doable hack

Authorities within the Bahamas stated on Sunday they have been investigating doable prison misconduct.

“In gentle of the collapse of FTX globally and the provisional liquidation of FTX Digital Markets Ltd., a staff of economic investigators from the Monetary Crimes Investigation Department are working carefully with the Bahamas Securities Fee to research if any prison misconduct occurred,” the Royal Bahamas Police Drive stated in a press release.

In the meantime, FTX is launching a probe of its personal. The corporate stated on Saturday it was wanting into crypto property that have been stolen and has now moved all its digital property offline.

On the identical weekend, one other crypto mishap alarmed traders.

Singapore-based Crypto.com stated it by accident despatched greater than $400 million (€389 million) in Ethereum to the improper account.