Households and businesses are set for more hip-pocket pain after regulators on Wednesday released draft details of electricity price rises in four Australian states.

The Australian Energy Regulator revealed residential customers on standard plans should brace for price increases of up to 24% in the next financial year. The price rises apply to households in Queensland, New South Wales and South Australia.

The Victorian regulator also flagged an electricity price hike of up to 30% in that state.

It’s another blow in an already difficult financial situation for many, as interest rates continue to rise and inflation soars. Consumers are justified in asking: why is this happening? And is there an end in sight?

Jono Searle/AAP

The basics, explained

The regulator released a draft of what’s known as the “default market offer”. It’s basically the maximum amount energy retailers can charge customers on default energy plans.

So what’s a default energy plan? It’s the standard plan you’re on if you didn’t negotiate a special deal with your energy retailer, or if a deal you were on has expired.

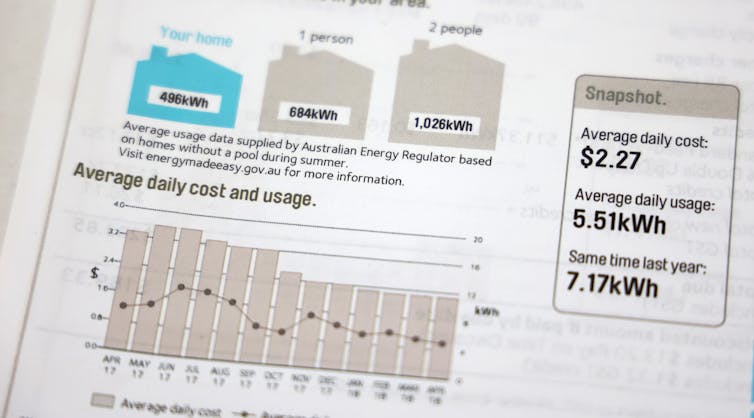

According to the ABC, around one million electricity customers in the four states mentioned above are on default market offers.

Many consumers are on default plans because they don’t have the time or inclination to engage with their electricity retailer to negotiate a better deal. Others, quite understandably, find the whole process too confusing to navigate.

That’s why default market offers were introduced. Both the federal and Victorian policies were developed after reviews found competition in retail electricity markets was not leading to lower prices for households or small businesses.

The Victorian default offer began in 2019. The federal measure was applied in 2020.

The regulators release a draft determination ahead of a final decision, expected soon.

First look at the new settlement rule of Australia’s electricity market, has it worked?

David Mariuz/AAP

So why the price hike?

Your electricity bill comprises several different charges. The biggest ones are:

– wholesale energy costs: the price generators such as coal and gas plants charge your retailer for the electricity delivered to you

– network costs: the price charged by companies that own the “poles and wires” – transmission lines, transformers, electricity poles and the like – needed to get the electricity to your home

– retail costs: the total amount needed by an electricity retailer to operate – such as issuing bills, providing customer service, marketing themselves – as well as to make a reasonable profit.

Regulators calculate the default market offer by considering each of these price components.

Shutterstock

The increased default market offers are mostly due to increases in wholesale prices.

Wholesale prices increased in recent months almost entirely as a result of sanctions imposed on Russia following its invasion of Ukraine. It led to a global shortage of natural gas. This was exacerbated when Russia withdrew gas supplies from the European market.

Even though the energy shocks were happening half a world away from Australia, it affected domestic gas prices here. Why? Because most of Australia’s east coast gas is exported, which means its price is largely determined by the global price.

Energy bills are spiking after the Russian invasion. We should have doubled-down on renewables years ago

This could have been avoided if the federal government has a mechanism to keep some of that gas for the domestic market – in other words, if it had a so-called “gas reservation policy”. But the current and previous governments have refused to implement this.

The federal regulator said the planned retirement of AGL’s ageing Liddell coal-fired power station in the NSW Hunter Valley contributed to its decision. Liddell is one of the biggest coal-fired generators in the national electricity market, and the closure is likely to lead to a short-term tightening of supplies.

Another factor affecting the regulators’ decision relates to a strategy electricity retailers use to protect themselves against volatile wholesale prices in future. The strategy, known as hedge contracts, fixes the wholesale price retailers pay for electricity over a long period – up to several years.

The price set in hedge contracts struck over the past year or so was influenced by Australia’s domestic gas crisis in 2022, which caused massive rises in wholesale electricity prices.

Shutterstock

What to expect down the track

Australian Energy Regulator chair Clare Savage on Wednesday said the price increases could have been much higher, if not for intervention by the Albanese government late last year to cap prices in Australia’s gas and coal markets.

Climate Change and Energy Minister Chris Bowen says those price caps have saved households between A$268 and $530.

The caps are likely to cause further falls in the default market offer in coming years. But the policy appears to be only an interim measure until the global supply shortage eases.

In the longer term, renewable energy offers a ray of hope.

The federal government has set a target of 82% renewable electricity by 2030. But of course, a few significant complementary measures – such as more investment in transmission networks and energy storage – are needed.

This investment would support the transition to a zero-emissions electricity sector. Importantly, it would also insulate long-suffering consumers from volatile fossil fuel prices.

Will your energy bills ever come down? Only if Labor gets serious with the gas majors