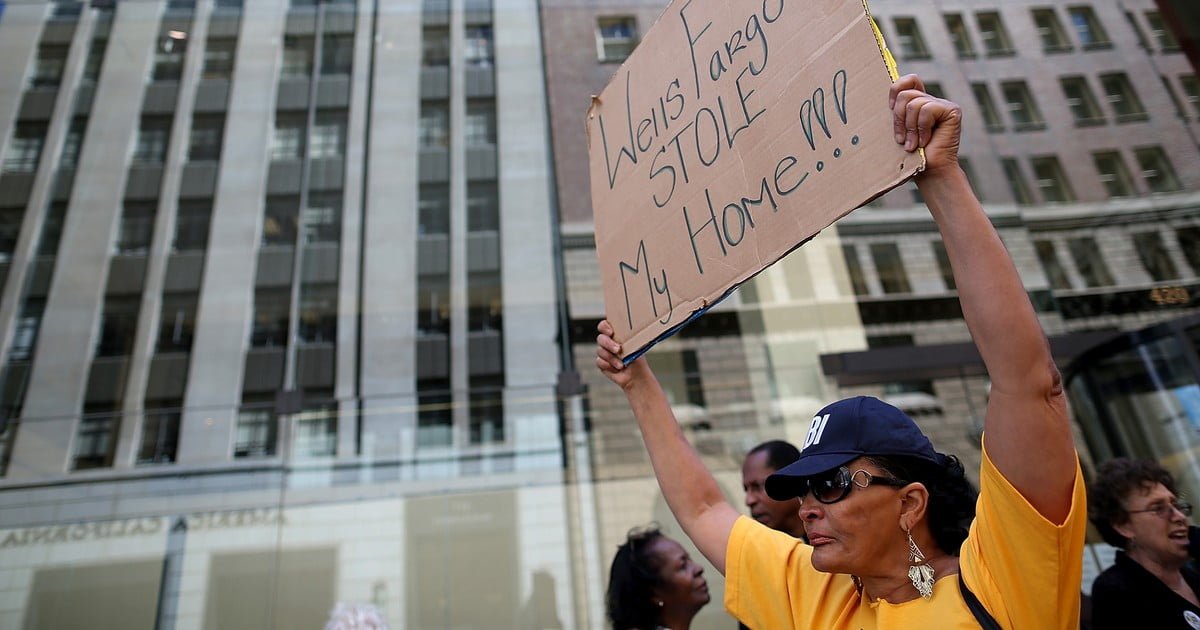

Progressive advocacy groups cheered Tuesday after federal regulators at the Consumer Financial Protection Bureau ordered Wells Fargo to pay $3.7 billion in fines for a wide range of “illegal activity” that harmed millions of U.S. households, including charging surprise overdraft fees, wrongfully foreclosing on homes, improperly denying mortgage modifications, and unlawfully repossessing vehicles.

“The CFPB’s actions today send a loud and clear message: Wells Fargo is not above the law,” Sarah Miller, executive director of the American Economic Liberties Project (AELP), said in a statement.

“It is time for regulators to stop individually picking away at the Wells behemoth, and start coordinating to genuinely bring this bank to heel.”

“This $3.7 billion fine will leave a massive mark on one corporate America’s worst repeat offenders and provide relief to the millions of Americans they cheated,” said Miller. “It is part of a broader suite of efforts the CFPB is bringing to create systemic change in corporate America and yet another example of the agency’s commitment to protecting working families from corporate abuse.”

Tuesday’s settlement, which requires Wells Fargo to pay $2 billion in redress to 16 million consumers and a $1.7 billion civil penalty for legal violations, is the largest in the history of the CFPB, which was founded 11 years ago as millions of predatory lending victims were being thrown out of their homes. Notably, the CFPB’s order does not grant immunity to any of the bank’s executives nor does it negate claims for any ongoing illegal acts or practices.

In a statement, Wells Fargo CEO Charlie Scharf said that “we and our regulators have identified a series of unacceptable practices that we have been working systematically to change and provide customer remediation where warranted.” Scharf called the agreement “an important milestone in our work to transform the operating practices at Wells Fargo and to put these issues behind us.”

Jeff Hauser, executive director of the Revolving Door Project, said that “by returning $2 billion to defrauded customers’ pockets, CFPB Director Rohit Chopra continues to be the model whom all other regulators should aspire to resemble.”

“I don’t expect this excellent news to persuade any Republican members of Congress, whose objections to Chopra have never been in good faith,” said Hauser. “But any fair-thinking onlooker should see that he is laser-focused on serving the people—not scoring political points or picking winners and losers, as the right often, desperately, alleges.”

“The problem is that the CFPB cannot, by itself, solve what’s wrong at Wells Fargo,” Hauser continued. “The CFPB’s consumer protection mandate doesn’t grant it the legal tools to address all of the systemic issues at the top of Wells’ org chart—it can treat the symptoms of Wells’ diseased policies, but it cannot tackle the disease itself.”

“Chopra is genuinely doing all that he can, but other agencies, which have the proper tools to restrict and restructure the business itself, need to step up and find some of his fearlessness,” Hauser asserted.

In his remarks announcing the CFPB’s law enforcement action against Wells Fargo, Chopra made clear that while providing restitution to victims is “important,” it is “an initial step” toward the long-term goal of “finding a permanent resolution to this bank’s pattern of unlawful behavior.”

Calling the banking giant “a corporate recidivist that puts one-third of American households at risk of harm,” Chopra acknowledged that Tuesday’s order “will not fix Wells Fargo’s fundamental problems.” He urged regulators to “collectively consider whether additional limitations need to be placed on Wells Fargo to supplement the existing asset cap put in place by the Federal Reserve Board of Governors in 2018, as well as the Office of the Comptroller of the Currency’s mortgage servicing restrictions imposed in 2021.”

Hauser called these “excellent proposals.”

“If Fed Vice Chair for Supervision Michael Barr cannot see that Wells’ lawlessness poses grave systemic risks, it will only confirm to us that his priority is advancing his career, not serving the people,” said Hauser. “Likewise, Acting OCC Director Michael Hsu should recognize that Wells’ failures go well beyond mortgage servicing.”

“Wells Fargo has contributed to a long-running, organized effort by greedy industries and politicians in their pocket to defang, defund, or do away with the CFPB because it works so well.”

“It is time for regulators to stop individually picking away at the Wells behemoth,” Hauser added, “and start coordinating to genuinely bring this bank to heel.”

Meanwhile, the watchdog group Accountable.US praised the CFPB for “its latest major effort to make things right on behalf of wronged consumers” and argued that Tuesday’s crackdown on “scandal-plagued Wells Fargo” provides “another reminder why the financial giant is tied to a lawsuit seeking to cripple the agency’s ability to protect consumers.”

“Once again, Wells Fargo messed around with consumers’ hard-earned money and found out that behavior will not stand from the CFPB,” said Liz Zelnick, director of the Economic Security and Corporate Power program at Accountable.US. “It’s obvious why Wells Fargo is linked to a lawsuit threatening to keep the CFPB from protecting consumers from the kind of financial industry abuse the banking giant is notorious for.”

“Wells Fargo has contributed to a long-running, organized effort by greedy industries and politicians in their pocket to defang, defund, or do away with the CFPB because it works so well to protect consumers from schemes, scams, and predatory behavior,” Zelnick continued. “This is all about payback from Wall Street banks and shady industries with an ax to grind that would rather go after the cops on the beat than stop mistreating working people.”

Like Hauser, Zelnick does not “expect the CFPB’s latest win on behalf of consumers to receive much fanfare from incoming Republican [House Financial Services Committee] Chairman Patrick McHenry [N.C.], who’s taken millions from the financial industry—including over $100,000 from Wells Fargo alone.”

In response to a separate lawsuit brought by the payday lending industry, a three-judge panel from the U.S. Court of Appeals for the 5th Circuit ruled that the CFPB’s funding structure is unconstitutional, as Common Dreams reported in October. Former President Donald Trump pushed the 5th Circuit court in an even more conservative direction by appointing numerous far-right judges, including the trio of panel members.

The right-wing judges—led by Cory Wilson, who received at least $10,500 in campaign cash from Wall Street when he was a Republican candidate for and member of the Mississippi House of Representatives between 2014 and 2018—argued that the CFPB’s structure is unlawful because its funding comes from the Federal Reserve System rather than Congress, a feature that seeks to ensure the agency’s independence.

McHenry celebrated the decision, saying that he was “glad to see” it and hopes to bring the CFBP “under the appropriations process,” where it would be vulnerable to cuts from a hostile GOP.

In Zelnick’s words, “McHenry has made clear he is far more interested in protecting the bottom line of his industry donors than the consumers they routinely mistreat.”