Increased social awareness and pressure from shareholders in the investment fund industry have prompted sustainable funds to take off.

The latter are particularly attractive to retail investors because they offer access to a wide range of assets and risk profiles. In recent years, however, this industry has had to contend with an increasingly competitive environment:

- The growth of passive investing, which seeks to replicate indices in an attempt to obtain the same profitability as the market average and with the lowest possible risk.

- Competition between management companies, which has been rising as a consequence of globalization.

These are some of the factors that have caused investment fund average fees to drop in recent years. This, in turn, has prompted the search for new management approaches and products.

One of the areas with the greatest growth has been that of sustainable investment funds with an ESG (environmental, social and governance) approach. In part, this success is down to new, eco-aware generations.

Sustainable investments are an investment style and are not associated with a specific risk level or asset type, but can be made through equities, bonds or alternative assets.

They include non-financial criteria linked to three pillars: environment, society, governance.

- The environmental criterion includes material factors related to nature: carbon emissions, energy and water use, energy efficiency and waste processing.

- The social criterion refers to the stakeholders with which the company interacts: customers, suppliers, employees or the community. It focuses on social principles such as equality, diversity and human rights.

- The governance criterion refers to the good governance of the company (board composition, executive pay, risk and audit committees).

Possible greenwashing?

These funds have gone from occupying a market niche in the market to becoming a trend. According to Bloomberg estimates, it is expected that assets managed with sustainability criteria could account for one third of the world’s total by 2025, around 50 trillion dollars, strongly rising from the estimated 35 trillion in 2020. This growth, however, is not without its challenges and doubts.

The press has recently reported possible cases of greenwashing that have eroded the sector’s reputation. Take the recent case of Deutsche Bank DWS, which is currently being investigated for marketing its financial products as more environmentally friendly than they actually are.

Another case with significant media coverage was the post published in August 2021 by Tariq Fancy, former director of sustainable investments for the BlackRock fund. In his essay, Fancy suggested that the investment strategy of sustainable funds, as it is structured today, was a “lethal distraction” from the true systemic risk on which governments should focus.

EU: leader in sustainability

The EU has established itself as a prime cheerleader for sustainable investment through initiatives such as the Taxonomy Regulation, which aims to create a classification system for environmentally sustainable economic activities.

One of the principles included in this taxonomy is to avoid causing significant harm: activities classified as sustainable must indeed avoid harming other objectives established in the standard.

In the framework of the European Green Deal, and oriented to the investment fund industry, the Sustainable Finance Disclosure Regulation (SFDR) was approved in November 2019. This regulation, which came into force in March 2021, has a threefold objective:

- Promote greater transparency on the integration of sustainability criteria (ESG) in EU management companies.

- Define, harmonise and categorise funds to prevent potential cases of greenwashing from emerging.

- Mobilise and facilitate the redirection of money flows towards a greener and more sustainable circular economy. This objective is key since climate action requires both public and private investment efforts.

Categorization of funds

To give teeth to the legislation, management companies classify their investment funds into three articles:

- Article 6, for investment funds “without sustainability goals”. These are nevertheless required to explain how ESG considerations are integrated or, if not, why these risks are not relevant.

- Article 8, for investment funds “that promote or encourage social and environmental initiatives”, also informally known as light green funds.

- Article 9, for investment funds “with explicit sustainability goals”, dark green funds, for their greater commitment to sustainable criteria. These funds should explain their goals, how success will be measured, and against which indices or measures they are compared.

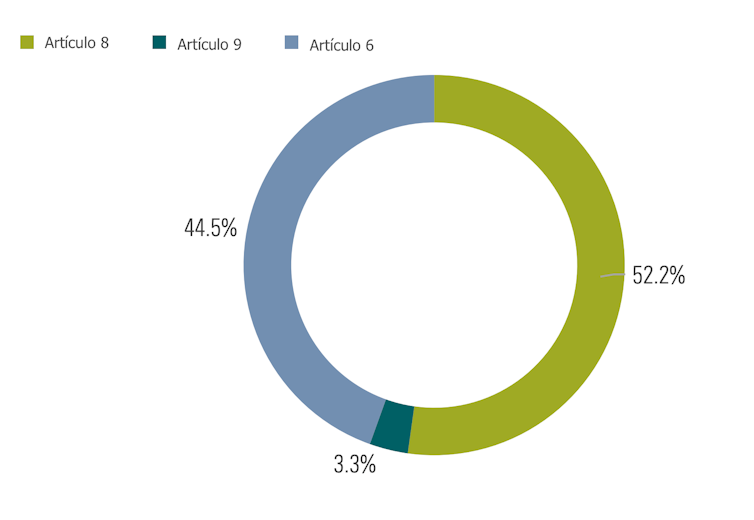

According to the latest report by the American financial services firm Morningstar, the most restrictive funds represented less than 5% of the total European investment funds at the end of the second quarter of 2022, compared to almost 45% of light green funds. The rest fell into the category of investment funds “without sustainability goals”.

Fuente: Morningstar

Additional regulation

As a result of the Markets in Financial Instruments European Directive(MiFID), since 2018 small European investors also have to undertake a suitability assessment when approaching investment channels. This suitability assessment evaluates the investor’s profile: financial situation, expected profitability, risk tolerance, knowledge, experience and investment time horizon.

Since August 2022, the assessment also includes questions about the investor’s sustainability preferences. This means that distributors will have to adapt their procedures to ensure that at least one investment product suited to the client’s preferences is on offer.

This assessment could further boost sustainable investments by incentivising financial agents to sell products that have been labelled as sustainable by the SFDR or the taxonomy. On the other hand, failure to have any ESG products for show could push away potential clients.

Green and in the future

While certain steps need to be taken to ensure the SFDR and MIFID II are correctly implemented, there is no denying that sustainable investments are taking up an increasing share of the market.

In June 2022, sustainable investment funds already accounted for more than 50% of the European market, although this growth has also been overshadowed by doubts and possible cases of greenwashing.

The fact is that this green model can become a key instrument to support the goal of achieving a more sustainable economy in the era of climate change.