The African Development Bank and the Alliance for Financial Inclusion (AFI) have renewed a project partnership to support policy and regulatory reforms increasing access to financing for Africa’s women-led small and medium-sized enterprises, for a further four years.

The Bank’s Gender Equality Trust Fund will contribute over $4 million in grant funding to the project. The announcement came on 13 September during the 2023 AFI Global Policy Forum in Manila. AFI is a global policy leadership alliance owned and led by central banks and financial regulatory institutions with the common purpose of advancing financial inclusion around the world.

Under the new agreement, the African Development Bank and AFI will carry out new research in 13 additional African countries to identify opportunities for reform in policies and regulations that would have the greatest impact in addressing obstacles to accessing finance. The partners will work with policymakers, financial regulators, and other key stakeholders across the 20 target countries to design and implement these reforms.

The Bank’s flagship Affirmative Finance Action for Women in Africa (AFAWA) initiative will implement the project in conjunction with AFI. AFAWA works to close the finance gap for African women entrepreneurs.

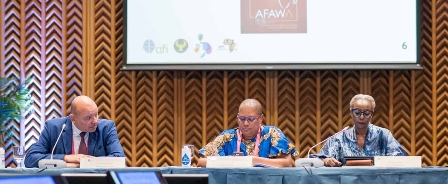

African Development Bank Director for Gender, Women and Civil Society, Malado Kaba, said the Bank was thrilled to launch this new chapter in their long-standing relationship with AFI. “Over the next four years, we will create a new model for gender-sensitive policy and regulatory reforms, which can be applied by governments across the continent to unlock the power and potential of women entrepreneurs,” she said.

Kaba said the project builds on the findings from earlier in-depth research undertaken by both partners in the Democratic Republic of the Congo, Morocco, Nigeria, Rwanda, Senegal, Zambia, and Zimbabwe.

AFI Executive Director Dr Alfred Hannig said while Africa had the highest percentage of women entrepreneurs in the world, women SMEs had the lowest rates of access to finance to grow their businesses. “AFI is delighted to launch an innovative partnership with the African Development Bank which will transform our understanding of how to close this financing gap,” he said.

While in Manila, Director Kaba and a Bank delegation held talks with Central Bank governors from several African countries. Kaba also participated in a roundtable discussion with donors and philanthropic organisations on how to bridge the global finance gap.