Football in Saudi Arabia has had a busy and expensive summer. When the transfer window of its top tier closed in early September, it had spent a record £767 million recruiting squad members from the world’s top football clubs.

This was more than each of the top leagues in France (£687m), Germany (£609m), Italy (£568m) and Spain (£324m). And it has sparked fears that the huge funds available to Saudi clubs could harm the quality and status of European football, for some big names have accepted lucrative offers to head to the Middle East.

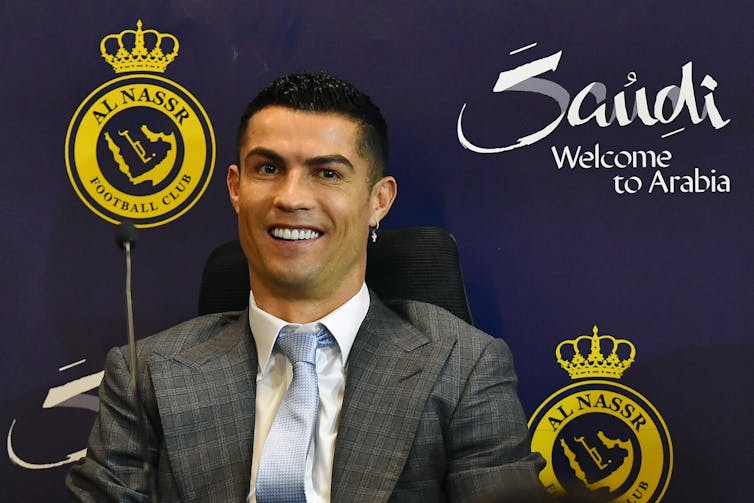

Since the statement signing of Cristiano Ronaldo in January 2023, players including Sadio Mané (who left Bayern Munich), Riyad Mahrez (Manchester City) and Neymar (Paris Saint-Germain) have followed.

For its part, Saudi Arabia is clear about its intentions – it wants the Saudi Pro League to become one of the best leagues in the world. And for that to happen it needs to attract the best players, who bring fans as well as skills.

So does all this spending really pose a threat to the European football business model?

The Premier League CEO, Richard Masters, certainly appears relaxed about the situation. And research has shown that football clubs tend to be more resilient to economic changes than other industries.

The summer transfer window of 2023 was a case in point. While other economic sectors continue to suffer the effects of high inflation and rising interest rates, the top end of English football appeared immune to economic worries.

Spending in the Premier League reached a new high of £2.36 billion, up from £1.9 billion last year. And out of the 20 most expensive global transfers, 12 were in England. (The Saudi Pro League had three.)

In fact, Saudi Arabia’s spending spree has actually provided the elite European clubs with a welcome business opportunity. Financial regulation rules (both national and European) mean the top sides need to sell players that are deemed surplus to requirements before they can buy any new players to strengthen the team.

The problem with this arrangement was that high transfer fees and wages could only be paid by a small group of other top clubs. The market for expensive unwanted players was extremely limited.

Now the Saudi Pro League has come charging in, and European clubs have some new and very wealthy customers. And because these Saudi clubs are part of a political project, there is an extra willingness to buy.

EPA-EFE/STR

In the short term then, European clubs have been presented with a new market which can afford to buy up their unwanted players – and not compete with them in domestic or European competitions.

So perhaps it’s not surprising that many in football don’t consider the influx of Saudi cash to be a problem. As Uefa’s president, Aleksander Ceferin, has commented: “It’s not a threat, we saw a similar approach in China.”

He added: “They bought players at the end of their careers by offering them a lot of money. Chinese football didn’t develop and didn’t qualify for the World Cup afterwards.”

But there are differences to what happened with the Chinese Super League (and in Major League Soccer in the US) in the past.

In Saudi Arabia, there is a lot more money being invested. And there is considerable political backing amid an urgent need for Saudi Arabia to diversify its economy away from oil and gas.

Nor are the Saudi clubs just targeting players at the end of their careers. Some of those who moved this summer will expect to have many years of football ahead of them. And a project where not just players, but also managers in their prime, are recruited successfully cannot be ignored.

Screen time

A key measure of Saudi Arabia’s tactics will be whether the world’s major broadcasters take an interest in the league’s matches. Broadcasting income is

a vital element of the game for elite clubs, but broadcasters can only pay to cover a certain number of events.

At the moment, the sporting calendar is already pretty full, so there are limited funds and airtime to offer new leagues. For now, this suits the well-established, leagues which have contracts and airtime nailed down.

But interests change, and so does broadcasting, with streamers like Amazon, Apple and Disney+ all providing live sport to subscribers.

And if the first stage of the Saudi Pro League’s game plan was to sign up some of Europe’s top players and managers, the next step may well be to secure valuable broadcasting deals and air time.

If that works, competing for sponsorship income could follow. At the moment, there are a limited number of companies worldwide which are willing and able to sponsor the most popular clubs and leagues. The elite clubs, with their global market recognition, can attract sponsors easily.

But the larger the pool of elite clubs becomes, the more competitive the market. If the Saudi Pro League clubs develop a global fan base, European clubs could face stiffer competition for sponsorship funds.

For now though, the Saudi league has plenty of funds of its own – and is more than willing to spend them. If that continues for many more transfer windows, European football clubs may understandably start to feel a bit more defensive.