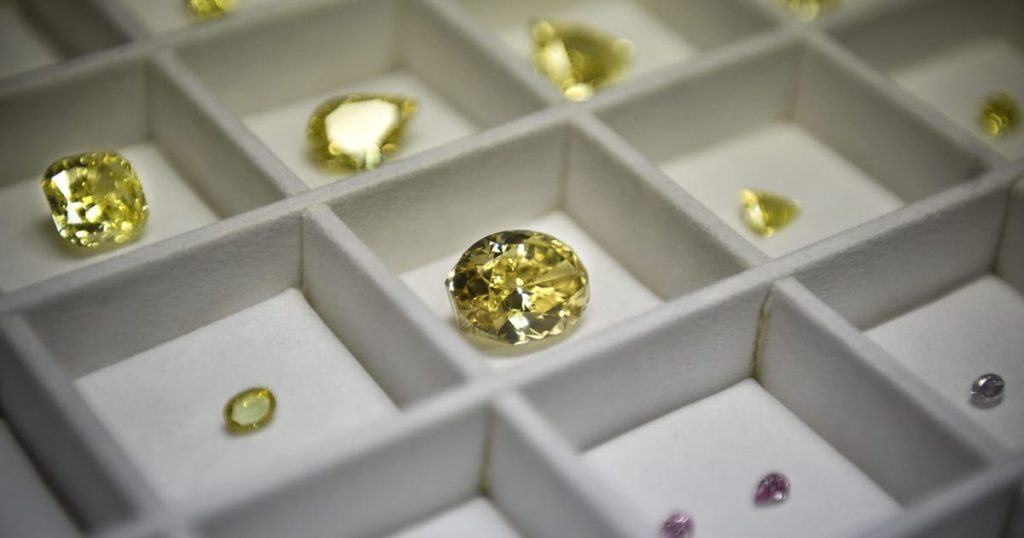

G7 leaders on Wednesday agreed to impose a direct import ban on Russian diamonds as of January, while introducing a tracing system for diamonds during next year.

Russian diamonds are one of the last resources not sanctioned by the G7, meaning the profits from selling them can go into the Kremlin’s war chest.

On Wednesday, G7 leaders decided to “introduce import restrictions on non-industrial diamonds, mined, processed, or produced in Russia, by January 1, 2024, followed by further phased restrictions on the import of Russian diamonds processed in third countries targeting March 1, 2024,” they said in a statement.

Countries that import rough diamonds within the G7 are set to establish “a robust traceability-based verification and certification mechanism for rough diamonds” by September 1, 2024, they decided.

The G7 countries said they needed that time to overcome technical difficulties in tracing the origin of Russian diamonds.

Washington sanctioned Russian rough diamonds in April 2022, and the EU has long discussed extending its sanctions to include diamonds. But Belgium, with its major diamond trading hub of Antwerp, held back European efforts, arguing that only a G7 ban would be effective to avoid circumvention.

Belgian Prime Minister Alexander De Croo pledged to support G7 efforts to kill Russian diamond revenues, which are funding President Vladimir Putin’s war against Ukraine.

Now, “Belgium welcomes the tracing system announced by the G7 today. It is an essential step to greatly reduce the flow of money from the diamond trade towards Russia,” De Croo said on Wednesday.

After Russian diamonds are cut and polished in India, they are considered to originate there, rather than in Russia. To close this loophole, the G7 also wants to consult “with other partners including producing countries as well as manufacturing countries for comprehensive controls.”

Tighter compliance and enforcement of the price cap policy on Russian oil is also planned, according to the statement. The $60-per-barrel cap on Russian crude oil has been in place since December last year, but some traders have been circumventing the rule by offering larger sums tagged as miscellaneous costs like transportation.

Under the new rules, buyers would have to prove they are buying Russian oil at the cap price. But there is criticism over the enforcement feasibility of the rule, as traders can lie, raising questions about the legitimacy of their declarations.

It’s now up to EU countries to agree on the bloc’s 12th sanctions package, which includes the diamond sanctions.

De Croo’s hope is to agree on this “in the coming days,” and before the European Council next week.