The Federation Account Allocation Committee (FAAC) has shared N655.932 billion revenue for April to the Federal Government, States and Local Government Councils.

Bawa Mokwa, Director, Press and Public Relations, Office of the Accountant of the Federation, made this known, via in a communiqué issued at the end of the FAAC meeting for May 2023.

The communique stated that the N655.932 billion total distributable revenue comprised distributable statutory revenue of N364.654 billion.

It said that it also contained distributable Value Added Tax revenue of N202.762 billion, Electronic Money Transfer Levy of N14.516 billion, N50 billion augmentation from Forex Equalisation Revenue and N24 billion augmentation from Non-Mineral Revenue.

The communique said: “In April 2023, the total deductions for cost of collection was N28.108 billion, and total deductions for transfers and refunds was N120.287 billion. The balance in the Excess Crude Account (ECA) was 473.754 million dollars.”

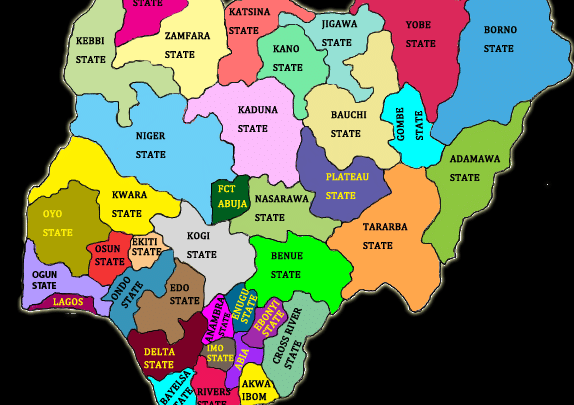

The communiqué said that from the total distributable revenue of N655.932 billion, the Federal Government received N248.809 billion, State Governments N218.307 billion and the Local Government Councils N160.6 billion.

It added: “A total sum of N28.216 billion was shared to the relevant states as 13 per cent derivation revenue.

“Gross statutory revenue of N497.463 billion was received for the month of April.

“This was lower than the sum of N638.673 billion received in the previous month by N141.210 billion.”

It said that from the N364.654 billion distributable statutory revenue, the Federal Government received N180.659 billion, State Governments N91.632 billion, and LGCs got N70.647 billion.

It said: “The sum of N21.716 billion was shared to the relevant states as 13 per cent derivation revenue. For the month of April 2023, the gross revenue available from VAT was N217.743 billion. This was lower than the N218.786 billion available in the month of March 2023 by N1.043 billion.”

According to the communique, the Federal Government received N30.414 billion, state governments N101.381 billion, and LGCs received N70.967 billion from the N202.762 billion distributable VAT revenue.

It said: “The N14.516 billion EMTL was shared as follows: the Federal Government received N2.177 billion, the State Governments received N7.258 billion and the LGCs received N5.081 billion.

“The total revenue of N50.000 billion from Forex Equalization was shared thus:

“The Federal Government received N22.916 billion, the state governments received N11.623 billion, the Local Government Councils received N8.961 billion and the sum of N6.500 billion was shared to the relevant states as 13 percent mineral revenue.

“From the N24 billion Non-mineral revenue, the Federal Government received N12.643 billion, the State Governments received N6.413 billion, and the LGCs received N4.944 billion

FAAC shares April revenues among FG, States, LGCs

The Federation Account Allocation Committee has shared N655.932 billion revenue for April to the Federal Government, States and Local Government Councils.

Bawa Mokwa, Director, Press and Public Relations, Office of the Accountant of the Federation, made this known.

The revelation was contained in a communiqué issued at the end of the FAAC meeting for May 2023.

The communique stated that the N655.932 billion total distributable revenue comprised distributable statutory revenue of N364.654 billion.

It said that it also contained distributable Value Added Tax revenue of N202.762 billion, Electronic Money Transfer Levy of N14.516 billion, N50 billion augmentation from Forex Equalisation Revenue and N24 billion augmentation from Non-Mineral Revenue.

The communique said: “In April 2023, the total deductions for cost of collection was N28.108 billion, and total deductions for transfers and refunds was N120.287 billion.

“The balance in the Excess Crude Account (ECA) was 473.754 million dollars.”

The communiqué said that from the total distributable revenue of N655.932 billion, the Federal Government received N248.809 billion, State Governments N218.307 billion and the Local Government Councils N160.6 billion.

It added: “A total sum of N28.216 billion was shared to the relevant states as 13 per cent derivation revenue.

“Gross statutory revenue of N497.463 billion was received for the month of April.

“This was lower than the sum of N638.673 billion received in the previous month by N141.210 billion.”

It said that from the N364.654 billion distributable statutory revenue, the Federal Government received N180.659 billion, State Governments N91.632 billion, and LGCs got N70.647 billion.

It said: “The sum of N21.716 billion was shared to the relevant states as 13 per cent derivation revenue.

“For the month of April 2023, the gross revenue available from VAT was N217.743 billion.

“This was lower than the N218.786 billion available in the month of March 2023 by N1.043 billion.”

According to the communique, the Federal Government received N30.414 billion, state governments N101.381 billion, and LGCs received N70.967 billion from the N202.762 billion distributable VAT revenue.

It said: “The N14.516 billion EMTL was shared as follows: the Federal Government received N2.177 billion, the State Governments received N7.258 billion and the LGCs received N5.081 billion.

“The total revenue of N50.000 billion from Forex Equalization was shared thus:

“The Federal Government received N22.916 billion, the state governments received N11.623 billion, the Local Government Councils received N8.961 billion and the sum of N6.500 billion was shared to the relevant states as 13 percent mineral revenue.

“From the N24 billion Non-mineral revenue, the Federal Government received N12.643 billion, the State Governments received N6.413 billion, and the LGCs received N4.944 billion

“In the month of April 2023, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Oil and Gas Royalties, Import and Excise Duties, and VAT all decreased considerably. Only EMTL increased, albeit marginally.”

“In the month of April 2023, Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Oil and Gas Royalties, Import and Excise Duties, and VAT all decreased considerably. Only EMTL increased, albeit marginally.”