Preamble: The Government of Ghana’s (GoG) public debt stock has increased significantly over the last 3-4 years. As a result, investor confidence in the country’s ability to refinance its debt had diminished, leading to downgrades by major credit ratings agencies, huge capital outflows and ultimately loss of Ghana’s access to international debt markets.

Following this loss, the GoG in July 2022 requested financial assistance from the International Monetary Fund (IMF) for a circa $3 billion Extended Credit Facility (ECF) to help mitigate its cavernous balance of payment deficits, restore macroeconomic stability and ensure debt sustainability.

As part of the IMF’s requirements for the ECF facility, a Debt Sustainability Analysis (DSA) was mandated. Findings from the DSA indicate that the GoG’s public debt stock is at unsustainable levels. Consequently, a comprehensive debt operation is required to re-profile the country’s debt stock to sustainable levels ahead of a decision on its IMF application for financial assistance.

On December 5, 2022, Ghana’s Minister of Finance, Ken Ofori-Atta announced a programme to restructure about ₵137.3 billion of the domestic debt component of the country’s debt. The domestic debt exchange programme involves replacement of eligible cedi-denominated GoG bonds with four new bonds maturing in 2027, 2029, 2032 and 2037.

The new bonds are respectively named ‘new 2027 bond’, ‘new 2029 bond, ‘new 2032 bond’ and ‘new 2037 bond’. The annual coupons on the new bonds are set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments on the bonds will be semi-annual. The principal on the bonds will be paid in four tranches of 17% in 2027, 17% in 2029, 25% in 2032 and 41% in 2037 therefore constituting a total nominal payment of 100%.

In short, the GoG will stagger delayed payments of bond coupons and principal for a predefined eligible class of debts (including ESLA Plc bonds and Daakye Trust Plc bonds) over an extended period ending in 2037.

The politics and the economics of ‘haircuts‘

Prior to the announcement of the GoG’s domestic debt exchange programme in December 2022, there had been much public speculation and discourse about the nature and extent of the haircuts (if any) that the programme will impose on investments in GoG securities. The president of the republic Nana Akufo Addo in a national address in October 2022 stated that “there will be no haircuts” on investments.

In the Minister of Finance’s announcement of the debt exchange programme itself, it is stated that the programme “does not entail any reduction in the principal amount (“haircut”) of the Eligible Bonds”.

Spokespersons for some opposition political parties and some academic and civil society organisations had argued however that there are extensive haircuts in the government’s programme. So, what is the truth about the haircuts in the GoG’s domestic debt exchange programme (if any)?

To settle the debate, let’s briefly introduce an important concept in economics and finance. This is the concept of the ‘time value of money‘; the notion that money today is worth more than money in the future. To explain this concept, assume that Kwaku Manu owes you ₵10,000 due you today (that is December 2022), but offers to pay you back in one of two ways – Plan A: ₵10,000 today; or Plan B: ₵ 10,000 in a year’s time (that is December 2023). Are the two payment plans equivalent?

Well, if you opt for Plan A and receive the money due you today (i.e. December 2022), you can put the money into a savings account in a bank offering say 10% simple interest annually, or a comparable investment opportunity with a similar return. By December 2023, the value of your money will be ₵11,000. If you opt for Plan B which involves waiting to receive your money in the future however (that is in December 2023), the value of your money in December 2023 will simply be the ₵10,000 received.

So you see, the two payment plans are not equivalent because money today is worth more than money in the future. In the above simple example, you gain an additional value of ₵1,000 in December 2023 simply by opting to receive the payment due you today (that is Plan A). Conversely, if Kwaku Manu proposes to delay payment and offers to pay you back your ₵10,000 in December 2023 only (that is Plan B), you would have implicitly suffered a value loss of ₵1000. The European Central Bank defines a financial haircut as ‘a reduction applied to the value of an asset‘.

If we adopt this definition, Kwaku Manu is said to have imposed a ₵1000 haircut on the value of your money simply by delaying payment due you today. Note that Kwaku Manu in December 2023 would still pay your ₵10,000 in ‘nominal terms’, but in ‘real terms’ you would have suffered a loss of ₵1,000 due to delayed payment.

This haircut would even be greater if we begin to account for inflation. The purchasing power of ₵10,000 in December 2022 could be much greater than it is in December 2023. With ₵10,000 in December 2022, you may be able to purchase a car of some kind. With the same amount in December 2023, you may not be able to purchase the same car due to inflationary factors.

By delaying payment, Kwaku Manu is reducing your purchasing power. There are other risks to delayed payment (e.g. what if Kwaku Manu dies, or goes bankrupt before December 2023 such that he is no longer able to pay) but lets not complicate matters. Let’s keep matters simple.

The above example, however simple, is not dissimilar to what is happening under the domestic debt exchange programme announced by the GoG. In the above analogy, Kwaku Manu is the GoG and you are the investor in GoG bonds. You lend money to the GoG by purchasing its bonds.

The GoG is now debt distressed and is unable to summarily pay you when payment is due. It has announced a debt exchange programme that effectively delays and staggers payment due you to the distant future. By delaying and staggering payment, you would necessarily lose some of the value of your investment in GoG bonds by virtue of the time value of money phenomenon explained above. In other words, you would automatically suffer a haircut. Let’s take matters a bit further by discussing bond valuation, and the extent of the haircuts suffered.

Bond valuation

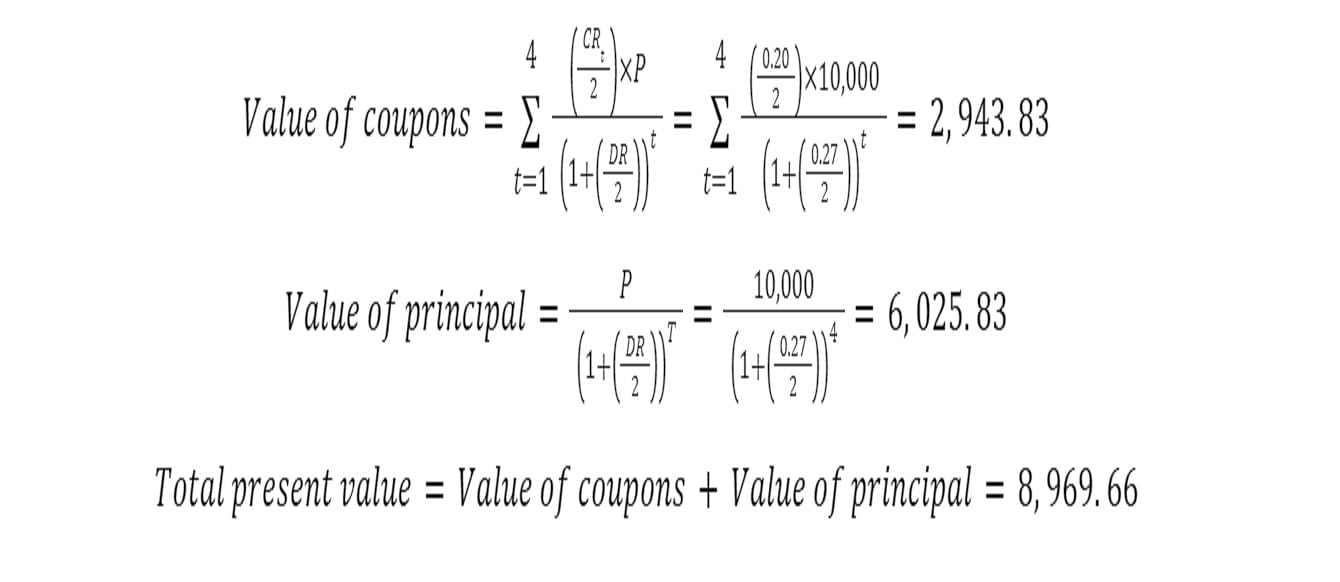

We will try to keep matters simple. OK so assume you have a GoG bond that is due to mature in 2 years (that is in December 2024). Also assume that the principal (P) on the bond is ₵10,000 and the annual coupon rate (CR) on the bond is 20%, which is paid semi-annually.

This means that you will receive four coupon payments over the next two years. Finally, assume a discount rate (DR) of 27%. The DR is the return required to entice an investor to invest in a bond, given its inherent risks and is typically assumed to be the yield to maturity of an equivalent bond on the market (check the Ghana Fixed Income Market).

What is the market value of your bond today? In other words, if you decide to sell this bond in the secondary market, what can you expect to get for it. Well, the present value of your bond can be calculated as follows;

So the total present market value of your bond is ₵8,969.66. You can also obtain the above results by using an online bond calculator.

Now assume that the issuer of your bond (in this case the GoG) decrees that it is unable to meet the financial terms of the bond and is therefore replacing your original bond with four new bonds with the new terms listed in its debt exchange programme, as cited in paragraph two above. What is the market value today of the four new bonds replacing your original bond? Is the aggregate value of the four new replacement bonds equivalent to the value of your original bond?

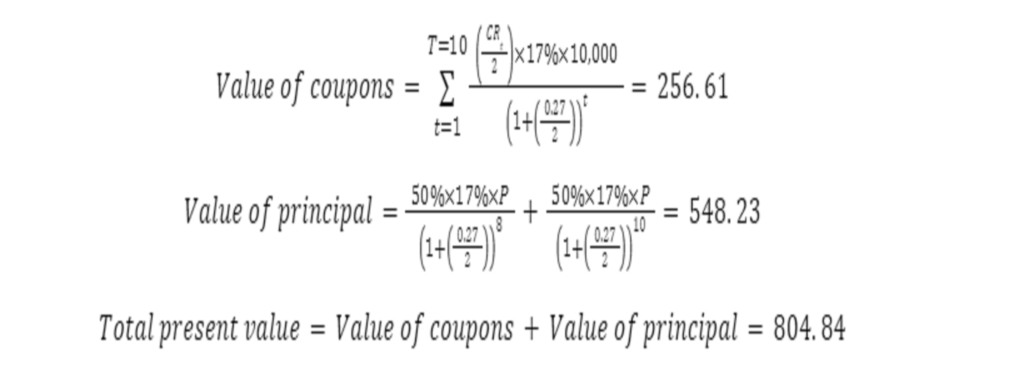

Well lets first take the GoG’s ‘new 2027 bond’, which is one of the four new bonds replacing your original bond. The principal on the GoG’s ‘new 2027 bond’ is 17% of the principal on your original bond (that is 17% of ₵10,000 = ₵1,700). Also, the coupon rate for this bond is 0% in 2023, 5% in 2024 and 10% in 2025, 2026 and 2027. The coupons are paid semi-annually so you can expect ten coupon payments by the end of December 2027.

This includes the ₵0.00 coupons in 2023 due to the 0% coupon rate for that year. Half of the principal on this bond will be paid in December 2026 (that is the 8th payment period), with the other half paid in December 2027 (that is the 10th payment period).

So what is the value of this bond today?

Well, the present value of your ‘new 2027 bond’ can be calculated as follows;

So, the total present value of the ‘new 2027 bond’ is ₵804.84. You can use the above procedure to obtain the value of the three other replacement bonds. I have done this and can report their values as ₵657.49, ₵792.04 and ₵1117.94 for the ‘new 2029 bond’, ‘new 2032 bond’ and ‘new 2037 bond’ respectively. So the total market value of the four new bonds replacing your original bond is ₵804.84 + ₵657.49 + ₵ 792.04 + ₵1117.94, making ₵3372.30.

So, your original bond of market value ₵8969.66, has now been replaced by the GoG’s four new bonds with total market value of only ₵3372.30. You have therefore suffered a haircut of ₵5,597.36, which is about 62.40% of your original bond’s market value.

The figure below gives a further demonstration of the extent of the haircuts suffered by an illustrative two-year bond with a ₵10,000 principal. The figure shows for example that a two-year bond with an original principal of ₵10,000 and an original annual coupon rate of 30% with semi-annual coupon payments will suffer up to 67.70% haircut in value under the GoG debt exchange programme. This of course is substantial.

Interested readers may contact me for the code underlying the above analysis.

Implications and conclusions

In conclusion, there are indeed extensive haircuts in the GoG’s domestic debt exchange programme. This includes haircuts on both the principal and coupon payments, in real terms. Individual investors and treasury bills are exempt from the GoG’s debt exchange programme.

Institutional investors such as regulated pension funds, commercial banks, mutual funds, special deposit taking institutions, insurance firms, asset managers and so on are however eligible.

Pension funds in Ghana are mandated by law to invest a proportion of their funds in government securities. The organised labour front in Ghana this week announced a major strike, beginning December 2027, in opposition to the government’s plan to include pension funds in its debt exchange programme. They have argued total exemption of pension funds from the programme, given the potential financial and social implications on the wellbeing of the Ghanaian worker.

Many commercial banks in Ghana are also heavily exposed to GoG securities and are expected to be significantly affected by the debt exchange programme.

The figure below shows that up to 10 major banks in Ghana have between 20 – 58 percent of their total assets invested in GoG securities. Capital buffers for these banks may be significantly affected, causing potential systemic risks to the entire financial sector in the country.

Source: SPGLOBAL market intelligence, 2022; IHS Markit, 2022

The bank of Ghana has announced that it will use some regulatory and supervisory tools to mitigate the impact of the debt exchange programme on banks and the financial sector. This includes for example a temporary reduction in the regulatory capital and liquidity requirements of banks, delay in the implementation of any new rules that may have an adverse impact on banks’ liquidity and solvency, the establishment of a ₵15 billion Ghana Financial Stability Fund to provide augmented liquidity support to banks who need it, and so on.

It however remains to be seen whether these measures will be sufficient to mitigate the adverse impacts of the haircuts in the GoG’s domestic debt exchange programme.

Author

Dr. Yakubu Abdul-Salam

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Tags: