Over half of Zambia’s population lived below the national poverty line in 2015. In rural areas, where 89% of households are engaged in agriculture, the poverty rate was even higher, at 77% of the population.

The government runs several programmes of financial support for farmers. Some provide agricultural inputs directly to households.

Agricultural input subsidies can encourage adoption of modern inputs like fertilisers, improved seeds or agro-chemicals, by making them more affordable. Input subsidies can be price-based, packages of inputs or input vouchers provided at a subsidised cost to eligible farmers.

There is a vast body of research showing that these policies can raise farm outputs and incomes. But there are also reservations concerning their effectiveness. Low and middle-income countries, including in Africa, also have other transfer policies that may be more effective in reaching the poor. They can also lead to improved agricultural production, as is the case with social cash transfer programmes.

Agricultural input subsidies represent a transfer of income to the targeted households. But eligibility criteria – such as requiring minimum farm sizes or membership of farming cooperatives – may reduce the likelihood of such support reaching the poorest farmers. Price-based subsidies offer the greatest benefit to people who farm on a bigger scale.

Small efforts can protect farmers from pesticides. Insights from Zambia

Tax instruments are needed to fund inputs provided to farmers and cash transfers to households. But they, too, have impacts on poverty and inequality. That is why a comprehensive assessment of agricultural policies as a part of the broader tax-benefit system is needed.

Our study

To fill this gap, we used tax-benefit microsimulation to assess the distributional impacts of agricultural policies in Zambia. The tax-benefit microsimulation model for Zambia, MicroZAMOD, enables policymakers and researchers to analyse and compare the effects of different benefit policy scenarios on poverty, inequality and government revenues. The earlier version of the model was expanded by us to better capture the main impacts of agricultural policies on household incomes.

The results show that Zambian agricultural policies reduce the share of households whose consumption falls below the poverty line by 3–5 percentage points. Although this does not solves the poverty problem in the country, it is still a sizeable effect among developing countries. The magnitude of poverty reduction depends on whether only the policies’ direct impacts are considered, or also behavioural impacts that lead to changes in agricultural production. We also examined whether it was possible to reach similar poverty reduction at a lower cost to the government.

Farming interventions in Zambia

The Zambian government has three key agricultural programmes:

The Farmer Input Subsidy Programme, introduced in 2002, represents farm input subsidies, or subsidised input vouchers or packs. It provides e-vouchers or input packs through direct distribution. This is subject to the farmer’s own contribution. The aim is to enhance smallholder farmers’ incomes, and food security at the household and national levels.

The Food Security Pack, established in 2000, is a social protection programme aimed at vulnerable, but viable, smallholder farmers. It consists of a package of inputs and a part of the crop is recovered by the community as a pay back.

The Food Reserve Agency buys farmers’ produce at set prices. This provides market access and stabilises prices. Its core aim is to manage strategic food reserves.

There have been a number of impact studies of these programmes. But, until now, there has been no systematic assessment of the agricultural policies as a part of the entire tax-benefit system in Zambia.

Tanzania’s tomato harvest goes to waste: solar-powered cold storage could be a sustainable solution

In our analysis, we wanted to capture how these policies affected poverty. We took into account their productive impacts, established by earlier studies. We simulated the impacts of extending the number of beneficiaries of the Food Security Pack.

The value of the package to a farmer is about 2,400 Kwacha (about US$130). Beneficiaries are households whose heads are not employed. They must also belong to categories of vulnerable households. These include being headed by females, children, terminally ill persons, unemployed youths or old people. Eligibility also requires them to be cultivating between 0.5 and 2 hectares of land, and having adequate labour.

Farming in South Africa: 6 things that need urgent attention in 2023

Until around 2020, the coverage of Food Security Pack was very low. In 2020 we modelled it to have 55,000 recipient households. In the 2022-23 farming season, the government goal is to reach 290,000 recipients, having already expanded the programme to 263,000 households in 2021-22.

The results of our simulations indicate that expanding the coverage of the package to 292,000 beneficiaries would reduce Zambia’s poverty headcount ratio by 0.9 percentage points, in comparison to the lower number of recipients (55,000).

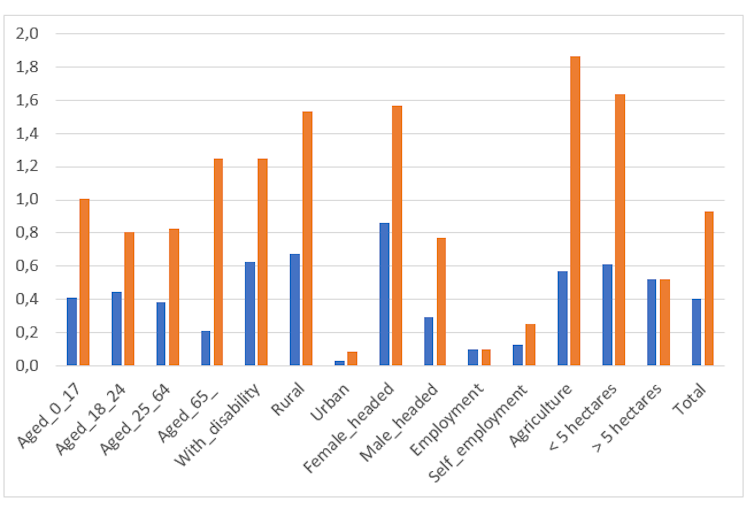

Part of the reduction in poverty stems from the benefit’s impact on households’ agricultural production. The Gini index, which measures income inequality, is also slightly reduced. This means lower inequality as a result of the package’s expansion. The cost of extension is estimated to amount to about 430 million Kwacha. Because of the targeting criteria, the household beneficiaries are mostly rural, agricultural households cultivating less than five hectares of land (Figure 1).

Supplied by authors

Female-headed households and households with elderly members benefit relatively more. The Food Security Pack is, therefore, effective in reducing rural poverty and inequality in Zambia. It shows that provision of inputs to vulnerable households is more cost effective in achieving these impacts compared to the Farmer Input Support Programme that targets smallholders with less focus on vulnerability.

In the light of these findings the Zambian government’s decision to expand the programme further is advisable.

Chickens from live poultry markets in Nigeria could be bad for your health – scientists explain why

Tax-benefit microsimulation is a useful tool to examine the economy-wide impacts of the entire taxation and social protection system. We have broadened its use with a more detailed analysis of agricultural policies. As the Zambian application shows, a joint analysis of agricultural and social support is key when designing well-targeted poverty reduction policies.

Mari Kangasniemi, a social protection officer in the Inclusive Rural Transformation and Gender Equality Division in the Food and Agriculture Organisation (FAO) of the United Nations, contributed to the research and this article.