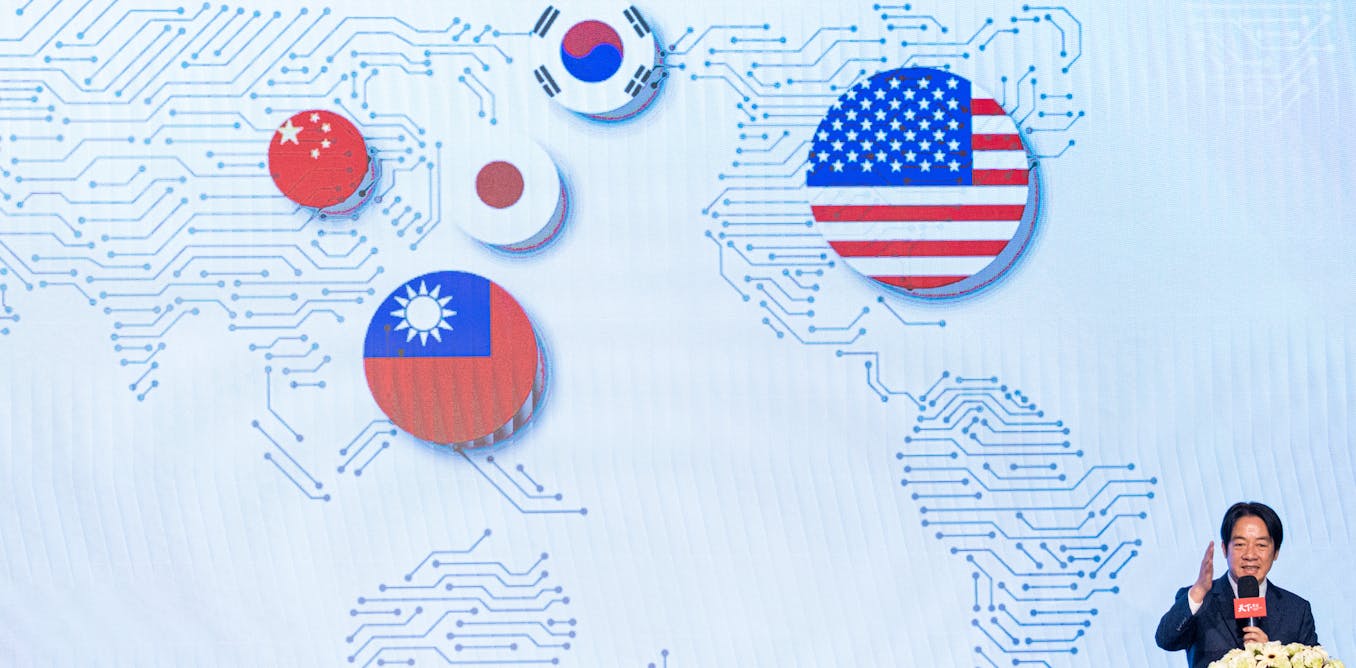

Tensions between China, Taiwan and the U.S. aren’t limited to aerial military maneuvers and drills on the high seas. The shadow conflict is also playing out in the technological arena.

One of the central drivers of the deepening geopolitical rifts between China on one side and Taiwan and the U.S. on the other is dominance over global semiconductor supply chains. This is because semiconductors – or microchips – power everything from smartphones and home office software to critical infrastructure and advanced military hardware.

As international demand for sophisticated microchips surges, not least owing to the blistering growth of artificial intelligence, so does their strategic value to the global economy and the progress of individual nations. China today spends as much importing microchips as it does importing oil.

This deepening reliance on semiconductors around the world adds another layer of complexity to simmering China-Taiwan tensions. Today, Taiwan is the world’s largest and most advanced microchip producer, and China is the planet’s biggest consumer of semiconductors.

As researchers in geopolitics and advanced technologies, we see the competition to control microchip supply chains as one of the defining struggles of the 21st century. Taiwan’s experience could serve as an example to the U.S., which on Sept. 6, 2024, announced a fresh wave of export controls on semiconductor goods.

The world’s chipmaker

Taiwan did not emerge as the world’s semiconductor powerhouse by accident. The self-governing island has been producing high-quality microchips for decades due in large part to its flexible production network and world-class engineering talent pool.

Yet Taiwan faces a delicate balancing act in maintaining its market superiority in semiconductors, especially when it comes to exporting advanced technologies to China. For one, Taiwanese policymakers are understandably determined to both avoid political entanglements with a country that views the island as its own territory and hold on to the island’s intellectual property. Moreover, Taiwan wants to keep microchips from powering Chinese missiles currently pointed at the capital, Taipei.

The road to regulating chips

Until the early 1990s, the transfer of technologies to China was prohibited under Taiwanese law. But regulations were weakly enforced. As a result, Taiwanese businesses frequently circumvented existing sanctions by rerouting investments through then-British Hong Kong. The reality was that the chip industry was a lucrative source of revenue for the island.

Taiwan’s approach to regulating the flow of technologies started to change in 1993 when President Lee Teng-hui implemented the “no haste, be patient” policy. The strict ban was relaxed and replaced by a system in which additional layers of oversight were added to highly advanced technologies, deals valued at more than US$50 million and specialized critical infrastructure projects.

Crafted over decades, this “outbound investment screening” system features multiple checks intended to safeguard Taiwan’s core chip technologies. Taiwanese authorities are actively involved in monitoring and overseeing investment decisions involving China made by the island’s semiconductor companies. Officials are also keen to ensure that local chipmakers are aligned with Taiwan’s strategic interests, while minimizing political ties with its neighbor.

During the screening process, Taiwanese companies are required to submit detailed investment plans to government-appointed reviewers for approval. For example, when a Taiwanese semiconductor firm, such as the world’s largest chip manufacturer TSMC, considers establishing a new facility in China, it must first undertake a rigorous approval process.

Changing calculations

While the cautious policy shift appears prescient today given rising geopolitical tensions, at the time it was considered out of step with the direction of more open global trade relations with China. The restrictive human rights considerations that had curbed Western trade with China were eased in the 1990s after intensive lobbying by U.S. corporations. In 2000, U.S. President Bill Clinton granted China permanent normal trade relations, paving the way for its accession to the World Trade Organization a year later. Trade with China, including of advanced technologies, exploded thereafter.

CFOTO/Future Publishing via Getty Images

But Washington’s strategic calculations over trade with China have shifted dramatically over the past decade. In 2018, the U.S. singled out China as a strategic competitor, designating several Chinese hackers and the government itself as national security threats. By August 2023, President Joe Biden directed the Treasury Department to draft regulations to develop an outbound investment security program to safeguard semiconductor, quantum and AI technologies.

A few months later, the U.S. issued sweeping restrictions on the trade of advanced chips and chipmaking equipment with China. In early 2024, the European Union released a white paper proposing to do the same.

Of course, Taiwan has its own specific political concerns when it comes to China. Given Beijing’s long-standing ambition to, as Chinese leaders put it, “reunify” Taiwan with the mainland, local officials are particularly aware how doing business with China might have unpredictable and damaging political ramifications.

The Taiwanese National Security Bureau has long warned that Beijing is using business to covertly advance its political ambition, including by leveraging Taiwanese capital to build influence and proxies within Taiwan. And in late 2023, Taiwan’s National Science and Technology Council announced a list of over 20 core technologies it wanted to prevent Beijing from acquiring, including know-how and raw material to make chips smaller than 14 nanometers.

New challenges for Taiwan’s regulations

Taiwanese authorities and businesses have built on the outbound screening system in order to push back against Chinese influence. In recent years, additional principles to protect Taiwan’s semiconductor dominance have been introduced, including requiring Taiwanese investors to retain a controlling interest in all Chinese subsidiaries.

Nonetheless, Taiwan’s outbound investment screening system is facing multiple tests. While it is designed to curb the transfer of advanced Taiwanese technologies to China, it also has to oversee financial investments from Taiwan into China’s surging chipmaking sector.

In 2022, for example, the Taiwanese technology group Foxconn announced an investment in Tsinghua Unigroup through its Chinese subsidiary. Tsinghua Unigroup is backed by China’s National Integrated Circuit Industry Investment Fund and controlled by a Beijing-based private equity firm. Owing to Foxconn’s failure to submit a required preapproval application to the outbound investment screening authorities, the Taiwanese government imposed a fine on the company, which eventually withdrew its investment.

Annabelle Chih/Getty Images

China’s growing chip industry is also expanding its local supply chain, raising questions about whether Taiwan should expand restrictions on other suppliers linked to semiconductor manufacturers. After the U.S. introduced export controls on China in late 2023, the Chinese firm Huawei aggressively expanded its chip production network by leveraging its affiliates and Taiwanese suppliers. Four Taiwanese semiconductor firms that had previously been approved for outbound investment were subsequently accused of aiding Huawei in building China’s domestic chip supply chain.

Confronting China’s ambition

With access to Taiwanese semiconductors increasingly restricted, China has aggressively pursued greater technological autonomy. It has done so by reducing its reliance on imports of advanced equipment and materials from U.S., Japan, the Netherlands and Taiwan.

There are legitimate concerns in the West that tightening international export restrictions on microchips and relevant suppliers could inadvertently strengthen China’s determination to accelerate the development of its domestic semiconductor production.

Official data appears to corroborate this view; China’s overall imports of microchips in 2023 were below 2017 levels. Exports of Taiwanese chips to China dropped by 18% in 2023.

Meanwhile, China’s National Bureau of Statistics reported that overall domestic chip production grew by 40% in the first quarter of 2024. Its share of global capacity to produce logic chips at 10-22 nanometers could rise from 6% to 19% by 2032.

But these data points do not necessarily mean that China is close to technological autonomy. Most of the increases in domestic chip production involve “mature” chips for household appliances and electric vehicles, rather than the most advanced chips required to accelerate AI computing power.

Meanwhile, China is still dependent on Taiwan for its semiconductors. The decrease in overall chip imports could be a result of international export restrictions on the most cutting-edge semiconductors needed for high-end smartphones and other AI-driven, high-performance computing products.

Coordinating international efforts

Restricting China’s access to the global superconductor supply chain is challenging. While doing so makes China reliant on Taiwanese chips – and as such may serve as a temporary protective shield against invasion – it could also exacerbate Beijing’s insecurities, pushing President Xi Jinping to hasten efforts to become technologically self-sufficient in advanced chips manufacturing. At the same time, outright bans on these chips hasn’t prevented China from producing a range of semiconductors using foreign capital and technology.

To address this challenge, Taiwan’s screening mechanisms not only need to remain nimble and vigilant – they need to be supported by a coordinated international approach. Only then will it be possible to slow the progress of authoritarian regimes in the AI race.