Since Australia’s Reserve Bank hiked interest rates two weeks ago, there have been two important developments – one in the United States and the other in the United Kingdom.

If it’s not clear to you why events overseas influence Australia’s interest rates, which are meant to be set to control Australian inflation, read on.

US and UK inflation close to zero

We haven’t been complete masters of our own destiny since the Australian dollar was floated 40 years ago next month.

What happened in the US last Tuesday was news of dramatically lower US inflation. When increases and decreases in prices were taken together, overall US prices moved not at all in the month of October. That’s right, inflation was zero.

While zero movement in one month doesn’t mean zero over the entire year, it helps bring down the rate over the entire year. US inflation fell from 3.7% in the year to September to 3.2% in the month to October.

Then the next day we got similar news from the UK.

Taken together, prices in the United Kingdom scarcely grew at all in October, climbing just 0.1%. The screeching halt to UK monthly inflation took the annual rate down from 6.7% for the year to September to 4.6% for the year to October.

In both the US and the UK, there’s talk there will be no need for further interest rate hikes – and very probably a case for interest rate cuts – as soon as next year.

We don’t yet know what happened to Australia’s inflation rate in October – the Bureau of Statistics will tell us next week.

But we have an early indication.

The Melbourne Institute inflation gauge, which roughly tracks the bureau’s measure, fell 0.1% in October. If that is what the bureau finds – that overall prices barely moved (or fell) in October – Australia’s annual inflation rate should fall from 5.6% for the year to September to around 5.2% for the year to October.

Inflation down all over

All over the world, inflation is falling for much the same set of reasons: the price of oil is heading back down after Saudi Arabia and Russia tried to restrict supply in the middle of the year, and the price pressures caused by shortages are easing.

As Australia’s Reserve Bank conceded in the minutes of the November board meeting, in which it pushed up rates, there has been “an easing in supply chain pressures and raw materials prices”.

Not that this means the bank is relaxed about what’s happening to inflation; far from it.

In the minutes released on Tuesday and in remarks delivered at a conference ahead of their release, Governor Michele Bullock said what concerned her was stronger-than-expected demand pressures. Australians remained keen to spend.

And she drew attention to disturbing

growing signs of a mindset among businesses that any cost increases could be passed onto consumers

But what has just happened overseas will help, big time. Here’s why.

Australians’ buying power just jumped

As soon as the news of low US inflation came out last Tuesday, the US dollar slid.

Investors became less keen to hold US dollars when it became less likely that US interest rates would rise further, and a good deal more likely they would fall.

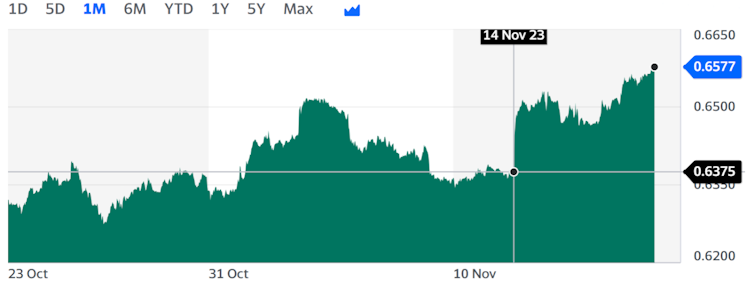

Against the Australian dollar, the US dollar fell 2%. From an Australian’s point of view, the buying power of an Australian dollar jumped from 63.7 to 64.9 US cents and has since jumped to 65.8 US cents.

A sudden jump in the value of the Australian dollar

Yahoo Finance

This means that, for as long as it lasts, Australian dollars will buy more than they did.

Australians will pay less in Australian dollars for the goods and services ultimately paid for with US dollars. The changed interest rate outlook in the US will act to keep Australian prices low.

In this way, decisions made in the US not to increase interest rates or even to cut them make it easier for Australia’s Reserve Bank not to increase rates – or even to cut them.

A higher dollar means lower inflation

The effect isn’t big. The RBA believes it takes a 10% change in the value of the Australian dollar to move the Australian

inflation rate 0.4 percentage points.

But it is better than things moving in the other direction, which is what has been happening until now.

For more than a year now, whenever interest rates have climbed in the US, Australia’s Reserve Bank has been under pressure to push up its rates to stop the Australian dollar falling and prices climbing.

No longer. After last week’s news from the US and the UK, Australian financial markets began pricing in a close to zero chance of further interest rate rises – with a fair chance of a rate cut next year.

Why it’s a good bet the Melbourne Cup Day rate hike will be the last

It’s always impossible to tell for sure what the Reserve Bank will do to rates. A lot will depend on what actually happens to inflation.

But for the first time in a long time, the Reserve Bank has tail winds from overseas, rather than headwinds.

For the first time in a long time, the bank won’t feel pressured to push up rates just because rates have been pushed up overseas.