The federal government knows people are doing it tough. Inflation and interest rate pressures have put the cost-of-living at the forefront of voters’ minds.

As the national accounts data shows, disposable income has fallen. Households have been forced to run down their savings. The household savings ratio has hit its lowest level in 16 years.

The mid-year budget update released on Wednesday confirms this. The Mid-Year Economic and Fiscal Outlook (MYEFO) estimates the economy is expected to expand by a low 1.75% in 2023–24. It also notes inflation – although moderating – is still too high. The outlook attributes that mainly to global oil prices.

There is a small glimmer of hope. The update predicts the economy will grow more strongly in 2024-25 due to rising real incomes and charts a decline in real income growth turning around in future years.

Hopefully that will happen. It is the only way Australian households will be able to cope with the cost of living.

A key challenge for the government

The challenge facing the government is that it can’t splash cash on easing cost-of-living pain without adding to inflation. Higher inflation would cause the Reserve Bank to raise its interest rate targets even further, making things worse.

There are ways to address the problem. Initiatives in the May budget, including measures to reduce energy and childcare costs, aimed to help households without putting pressure on inflation. The outlook notes these are still being rolled out.

But there are only a limited number of initiatives like this available to governments. Some are tempted to spend budget money instead. Treasurer Jim Chalmers has avoided that temptation. There’s no extra cost-of-living assistance package in this update. Instead, there is determination to rein in debt and deficit.

The fine line between surplus and deficit

The MYEFO 2023-24 budget balance is A$1.1 billion. That’s line ball between surplus and deficit. The balance is the difference between two much larger numbers: $685 billion in receipts and $686 billion in payments.

What’s more, these are estimates, not actuals. We won’t know how they turn out until the final budget outcome is released in October next year. In the meantime, we can expect another round of estimates updates in the May 2024 budget.

No self-respecting economist would claim it matters whether Australia has a surplus or deficit. What makes a difference to our national financial sustainability is how a government responds to the economic pressures it faces.

There are challenges but overall, the outlook is ok

On that measure, this is a responsible document. The revenue estimates have improved since the May budget, mainly due to global commodity prices. The government has spent little of this windfall.

Chalmers’ MYEFO media release says the government has returned 92% of upward revisions to revenue since the May budget. He says this means the government “will avoid $145 billion over 12 years to 2033-34 in interest costs on the debt we inherited”.

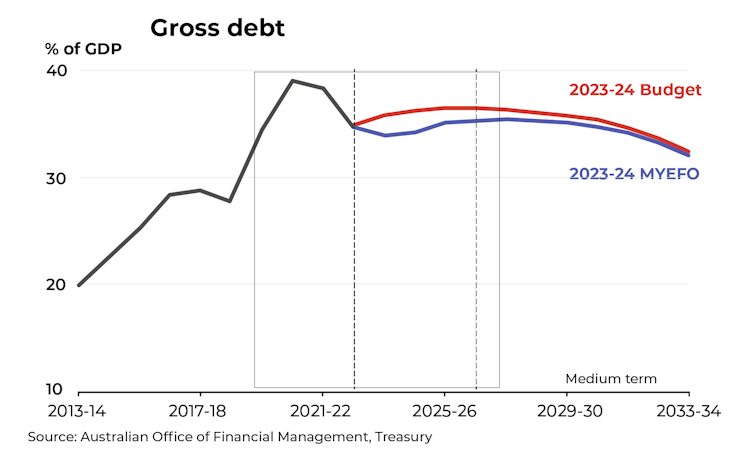

As a result, the forward estimates for the Australian government’s debt and deficit are lower at this point than at budget. Gross debt as a share of GDP is expected to peak at 35.4% of GDP in 2027-28, before declining.

There is an estimated $9.8 billion in savings, including already announced reductions in infrastructure spending. That was a good measure, because in addition to improving the budget bottom line it will have a direct impact on lowering building costs.

Offsetting those savings are a raft of new spending measures arising from decisions taken since the budget. They include defence support for Ukraine, aged care reform, additional money for ongoing COVID responses, new pharmaceutical benefit scheme listings, national water grid, housing and several hundred more. Many have already been announced.

The report gathers them together and adds them up. They add $1.1 billion to spending in 2023-23, $2.7 billion in 2024-25.

There are big announcements ahead …

Sadly, in a blow for budget transparency, there is still a line for decisions taken but not yet announced. We don’t know what decisions these are, but they are significant – the estimates start at $270 million in 2023-24 and rise to $1.8 billion in 2026-27.

It is impossible to tell what this spending is for. If the government were to reverse those decisions between now and the next budget update, we will never know.

On the plus side, this mid-year report has been released at roughly the mid-point of the financial year. Some previous reports have come out at different times – ranging from mid-October to late January (the latest it can be released under the Charter of Budget Honesty Act).

Chalmers has in the past expressed his desire to move back to a more regular and predictable budget processes. A MYEFO in December is normal and regular.

Budget update forecasts deficit of $1.1 billion this financial year