With the annual IRS tax filing deadline approaching, majorities of Americans continue to be bothered by the feeling that some corporations and wealthy people do not pay their fair share in taxes. Majorities also say they would like taxes on these groups to be raised.

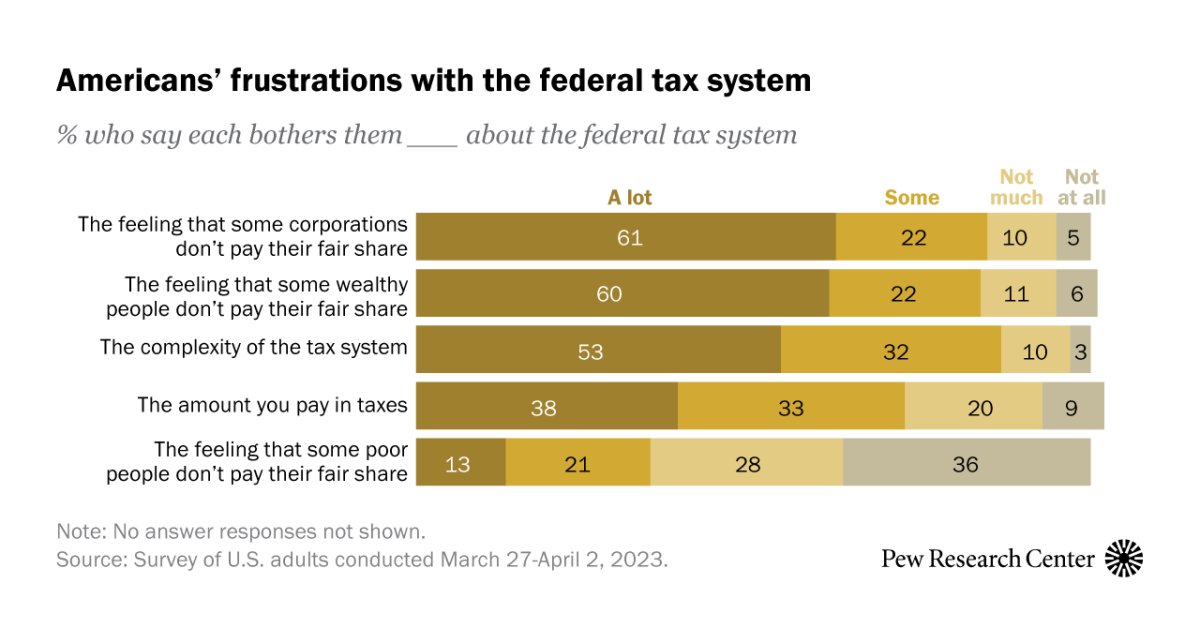

About six-in-ten adults now say that the feeling that some corporations don’t pay their fair share (61%) bothers them a lot, while a nearly identical share say this about some wealthy people not paying their fair share (60%), according to a Pew Research Center survey of 5,079 U.S. adults conducted from March 27 to April 2, 2023. These percentages are essentially unchanged since 2021.

About half of Americans (53%) now say the complexity of the federal tax system bothers them a lot, up from 47% who said this in 2021. About a third (32%) say the tax system’s complexity bothers them some, while 13% say it bothers them not much or not at all.

Ahead of Tax Day this year, Pew Research Center conducted this survey to assess the public’s attitudes about the federal tax system, paying taxes and possible changes to tax rates. For this analysis, we surveyed 5,079 adults from March 27 to April 2, 2023. Everyone who took part in this survey is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology.

Here are the questions used for the analysis and its methodology.

Roughly four-in-ten adults (38%) are bothered a lot by the amount they personally pay in taxes today, a modest increase from two years ago, when 33% said this. A third today say the amount they pay bothers them some, while 29% say it doesn’t bother them much or at all.

Only about one-in-ten Americans are bothered a lot (13%) by a sense that lower-income people don’t pay their fair share to the federal treasury. An additional 21% are somewhat bothered by this, while most Americans say this bothers them not too much (28%) or not at all (36%).

Partisans’ top frustrations with the tax system differ

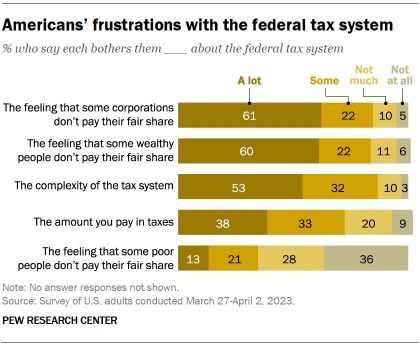

Republicans and Democrats, including those who lean toward each party, diverge in their frustrations with the federal tax system.

Democrats and Democratic leaners overwhelmingly say they are bothered a lot by the feeling that corporations and wealthy people do not pay their fair shares (77% say this for each). By comparison, fewer than half of Republicans and Republican leaners share those views (46% say this about corporations and 43% about the wealthy).

Republicans express their highest levels of frustration with the complexity of the tax system (59% say this bothers them a lot, compared with 49% of Democrats). Republicans are also more likely than Democrats to say the amount they pay in taxes bothers them a lot (44% vs. 31%). Few in either party say the feeling that some people with lower incomes don’t pay their fair share bothers them, though Republicans are more than twice as likely as Democrats to say this (19% vs. 8%).

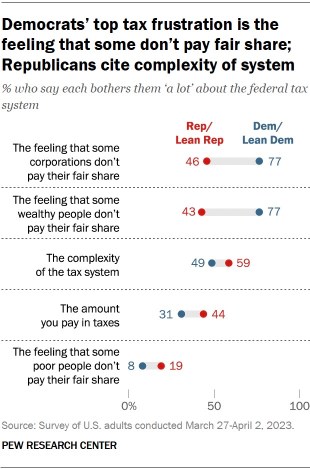

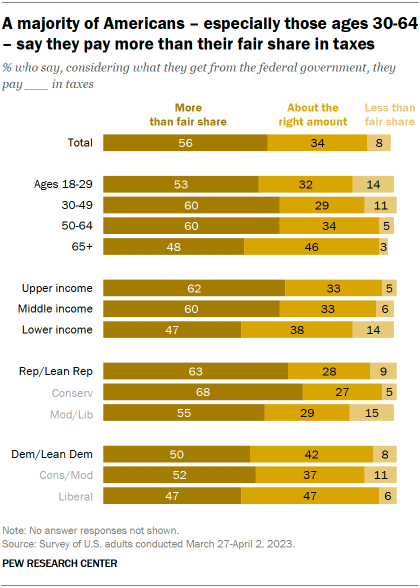

Narrow majority of Americans now say they pay more than their fair share in taxes

Today, 56% of Americans say that the amount they pay in taxes is “more than their fair share,” given what they get from the federal government, up from 49% in 2021. Roughly a third (34%) now say they pay about the right amount in taxes, while 8% say they pay less than their fair share.

Republicans are more likely than Democrats (63% vs. 50%) to say they pay more than their fair share to the federal government, but these percentages have increased in both parties over the last two years. The share of Republicans saying they pay more than their fair share has increased by four percentage points since 2021; among Democrats, it has increased by nine points.

Americans from upper- and middle-income households, conservative Republicans and those ages 30 to 64 are especially likely to say they pay more than their fair share in taxes to the federal government.

Six-in-ten adults ages 30 to 64 say their personal tax burden is too high, while smaller shares of those ages 18 to 29 and those 65 and older say the same (53% and 48%, respectively).

Upper-income (62%) and middle-income (60%) Americans are more likely than those with lower household incomes (47%) to feel their tax burden is unfair, given what they receive from the federal government. (Refer to the methodology for details on how household income tiers are determined.)

While Republicans overall are more likely than Democrats to say they pay more than their fair share to the federal government, conservatives in the GOP are particularly likely to say this. About two-thirds of conservative Republicans (68%) say they pay an unfair amount, compared with 55% of moderate and liberal Republicans. Among Democrats, there is no significant ideological gap in views of personal tax burdens (52% of conservative and moderate Democrats say they pay an unfair share, as do 47% of liberal Democrats).

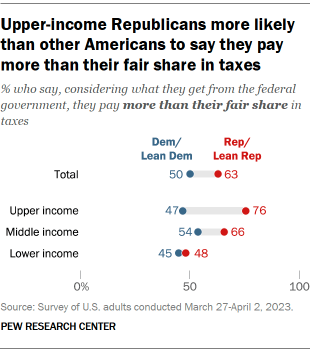

Republicans with higher household incomes are especially likely to be critical of the taxes they pay. About three-quarters of upper-income Republicans (76%) say they pay more than their fair share, while two-thirds of middle-income Republicans (66%) and about half of lower-income Republicans (48%) say the same.

By comparison, about half of Democrats across income tiers say they pay more than their fair share.

As a result, the partisan divide in views of one’s personal tax burden is particularly pronounced among upper-income Americans. About half of Democrats with high family incomes (47%) say they pay an unfair share in taxes, almost 30 percentage points lower than the share of Republicans in the same income bracket who say this (76%). In contrast, nearly identical shares of lower-income Democrats (45%) and Republicans (48%) say they pay too much.

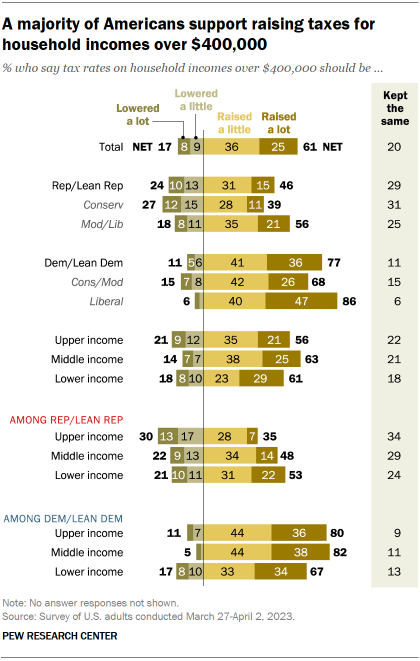

Majority of Americans support raising taxes on incomes over $400,000

About six-in-ten Americans (61%) favor raising tax rates for households that make more than $400,000, including a quarter who say these tax rates should be raised a lot and 36% who say they should be raised a little. Another 20% say tax rates for this group should be kept the same as they are now, while a similar share (17%) say taxes should be lowered for these households. These views are little changed in recent years.

Democrats – especially liberal Democrats – overwhelmingly favor raising tax rates for high-income households. About three-quarters of Democrats (77%) say tax rates should be raised for those with incomes above $400,000. That share jumps to 86% among liberal Democrats, including 47% who want rates to be raised a lot. A smaller majority of conservative and moderate Democrats (68%) want rates raised on these households.

Republicans are less likely than Democrats to say tax rates should be raised for those with incomes over $400,000, but more Republicans support raising rates for these high incomes (46%) than say rates should be kept the same (29%) or lowered (24%). Moderate and liberal Republicans (56%) are more likely than conservative Republicans (39%) to say taxes should be raised on these incomes.

Majorities of upper-income (56%), middle-income (63%) and lower-income (61%) Americans say tax rates should be raised on household incomes over $400,000. However, within both parties, support for raising taxes on high earners varies by household income.

Upper-income Republicans are the least supportive of raising tax rates for those with incomes over $400,000. About a third (35%) say this, compared with 48% of middle-income Republicans and 53% of lower-income Republicans.

Among Democrats, those in lower-income households are less supportive than those with middle and upper incomes of raising rates for incomes over $400,000. About two-thirds of lower-income Democrats say these taxes should go up, while about eight-in-ten middle-income (82%) and upper-income (80%) Democrats say the same.

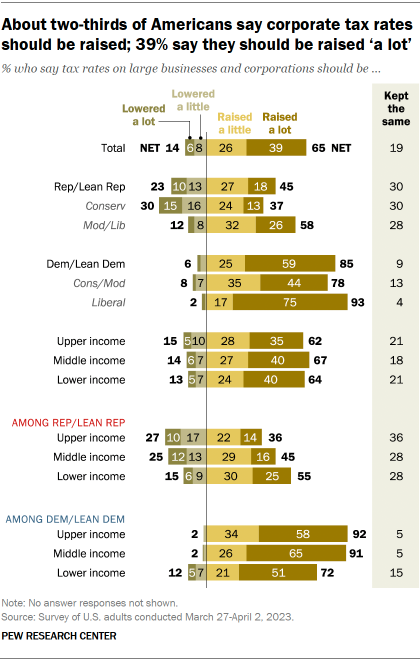

Most favor higher taxes on large businesses and corporations

A majority of Americans (65%) say that tax rates on large businesses and corporations should be raised a lot (39%) or a little (26%). About two-in-ten (19%) say large businesses’ tax rates should be kept about the same, while 14% say their taxes should be lowered a little (8%) or a lot (6%).

There are deep partisan divisions over raising tax rates for large businesses: 85% of Democrats say these rates should be raised at least a little, compared with 45% of Republicans.

Among Republicans, moderates and liberals are more supportive of raising taxes for large businesses and corporations (58% favor raising them a lot or a little) than conservatives. Conservative Republicans’ views are almost equally divided between raising corporate taxes (37%), lowering them (30%) and keeping them about the same (30%).

Among Democrats, large majorities of both liberals (93%) and conservatives or moderates (78%) say that large businesses and corporations should have higher tax rates. However, while three-quarters of liberal Democrats favor raising large businesses’ taxes a lot, a smaller share (44%) of conservative and moderate Democrats say the same.

When it comes to household income, Americans’ views of raising tax rates on large businesses and corporations are similar to the patterns observed in their attitudes toward raising taxes on incomes over $400,000. Among Democrats, those with lower household incomes are less supportive than those in higher income groups of raising large businesses’ taxes, while among Republicans, those with lower incomes are more supportive of higher corporate tax rates than those with middle or upper incomes.

Note: This is an update of a post originally published April 30, 2021. Here are the questions used for the analysis and its methodology.