The Albanese government decision to revise the Stage 3 tax cuts has ignited a political firestorm.

The government argues revising the plan to give bigger tax cuts to low-and middle-income earners struggling with the cost of living justifies breaking an election promise.

The opposition says the changes will make bracket creep worse in the long term because they will increase tax revenue by $28 billion over 10 years, relative to the original Stage 3 tax cuts.

The short-term winners and losers from the new tax plan are well documented.

People with taxable incomes of less than about $146,486, or nearly 90% of all taxpayers, will get either the same or a larger tax cut under the new plan.

Whereas the 10% with the highest incomes will get smaller tax cuts than under the original Stage 3 plan. The tax cut for people who earn more than $200,000 a year will be roughly halved, from $9,075 to $4,529 a year.

Stage 3 stacks up: the rejigged tax cuts help fight bracket creep and boost middle and upper-middle households

Bracket creep will reduce the value of these tax cuts over time

Australia’s tax scales are not indexed to wages growth or inflation. That means as our incomes rise, Australians pay a higher proportion of their income in tax.

Even if wage growth doesn’t push a taxpayer into a new tax bracket, most taxpayers will still end up paying more tax, because a larger share of their income will be subject to their highest income tax rate.

Over time, this so-called “bracket creep” increases average tax rates across the income distribution as wages grow.

Grattan Institute

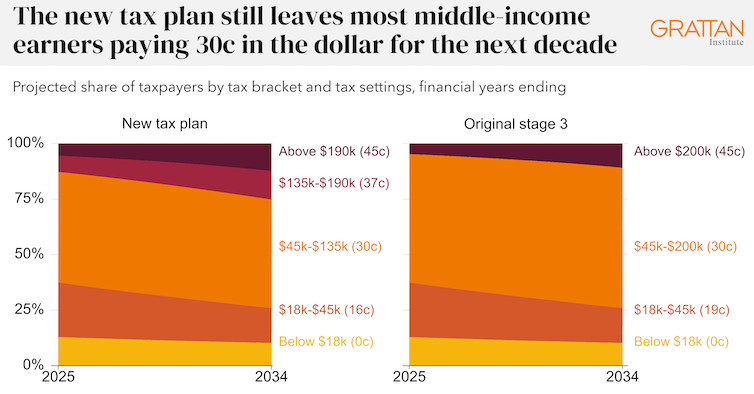

And one consequence of keeping the 37% tax bracket for incomes between $135,000 and $190,000 is average tax rates will rise more quickly for some upper-income earners than they would have under the original Stage 3.

The share of taxpayers with a taxable income between $135,000 and $190,000 is expected to rise from 7% in 2024-25 to 13% in 2033-34 due to bracket creep.

Middle Australia still wins in the long term too

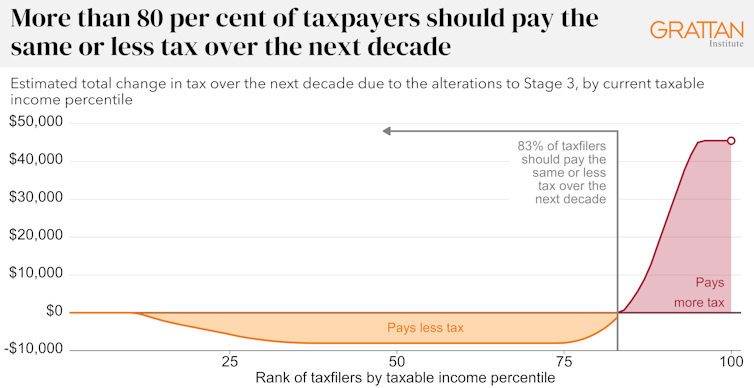

Grattan Institute’s analysis shows the vast bulk of Australian taxpayers will benefit from the revised tax package, despite the impact of bracket creep over the next decade.

For example, the typical (that is, median) taxpayer, with a taxable income of about $59,000 in 2024-25, can expect to pay $804 less in tax next year. As will someone on the average taxable income of about $79,000 in 2024-25.

And both can expect to pay cumulatively $8,040 less in tax over the next decade, compared to if the original Stage 3 tax cuts remained in place.

Overall, we estimate about 83% of taxpayers can expect to pay the same or less tax over the next decade than they would have under the original Stage 3 plan, despite the impact of bracket creep.

While the share of taxpayers facing a higher average tax rate each year under the new tax plan will grow over time – rising about the top 10% today to around 22% by 2033-34 – the accumulated savings over time means many higher-income earners will still be better off over the next decade.

But high-income earners will pay substantially more tax over the next decade under the government’s plan than under Stage 3.

Someone with a taxable income higher than 95% of all Australians – or about $197,000 in 2024-25 – will pay about $45,000 more in tax over the decade than if the Stage 3 tax cuts remained in place.

Grattan Institute

The budget is the biggest loser

But the biggest loser from the new tax plan may end up being the federal budget.

The government’s tax plan is expected to cost the budget more than $20 billion a year, or 1% of GDP. The Stage 3 plan would have cost about the same.

And the budgetary cost will be larger still if a future Coalition government were to keep the Stage 3 tax cuts for high-income earners and keep the bigger tax cuts for low and middle-income earners under Labor’s revised package.

That would increase the cost of the tax plan from $20 billion a year to up to upwards of $30 billion a year, and by up to an extra $115 billion over the decade.

The government’s tax plan will make it harder for this and future governments to meet community demands for more spending in areas such as healthcare, aged care, disability care, and defence.

These tax cuts could cost middle Australia more than it thinks.

The 2 main arguments against redesigning the Stage 3 tax cuts are wrong: here’s why