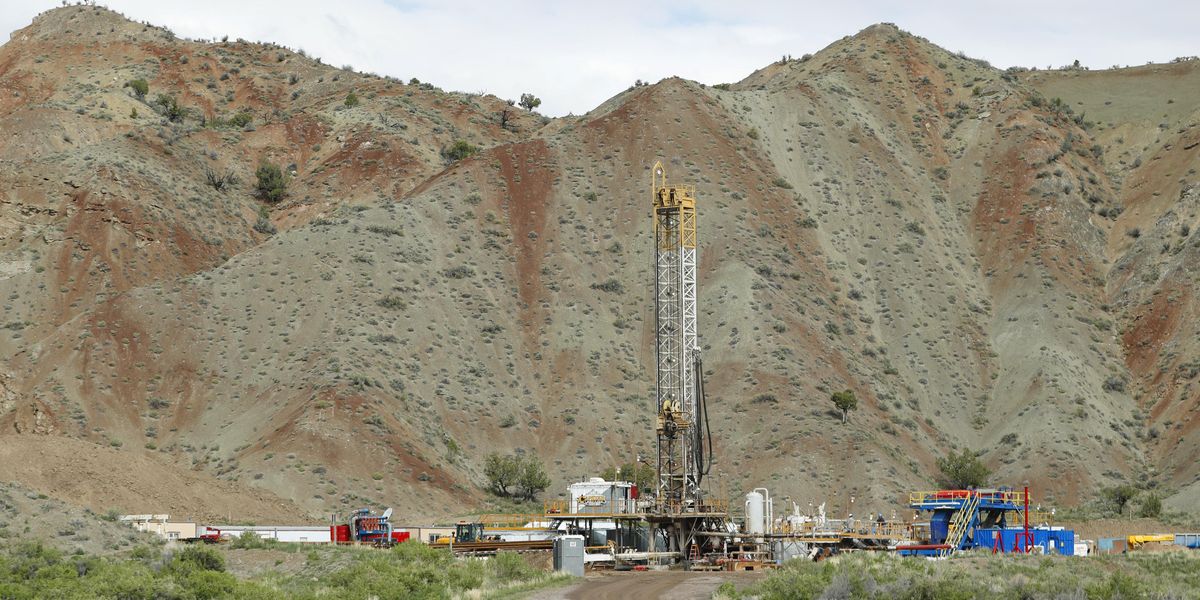

A trio of advocacy groups on Thursday urged the U.S. Interior Department to do more to fix the nation’s “broken oil and gas leasing system.”

Hundreds of progressive organizations, including Public Citizen, have called on President Joe Biden’s administration to halt fossil fuel extraction on public lands and waters. But Public Citizen, Project On Government Oversight, and Taxpayers for Common Sense argued in a letter to Interior Secretary Deb Haaland and Bureau of Land Management (BLM) Director Tracy Stone-Manning that as long as the federal leasing program exists, new rules should be implemented to protect taxpayers and communities.

“Taxpayers should not be footing the bill when an oil or gas company fails to plug a well.”

“It’s bad enough that we allow fossil fuel companies to drill on federal lands,” Public Citizen researcher Alan Zibel said in a statement. “The least we can do is ensure taxpayers don’t get stuck subsidizing the fossil fuel industry’s cost of doing business. It is unfair to expect taxpayers to pick up the bill when a company does not honor its promise to plug a well or pay for someone to do it.”

Zibel’s message was echoed by Project On Government Oversight policy analyst Joanna Derman, who said that “taxpayers should not be footing the bill when an oil or gas company fails to plug a well.”

According to Derman, the reforms proposed by the coalition “will bring much-needed accountability to ensure oil and gas companies clean up their hazardous mess on public lands.”

In their letter, the coalition urged the Biden administration to “reform oil and gas bonding, solidify an 18.75% minimum royalty rate for onshore oil and gas development, and implement protections that will make it harder for oil and gas companies to lock up federal lands that have little potential for oil and gas drilling.”

The Inflation Reduction Act (IRA) “contains several important oil and gas reforms that will help bring the federal oil and gas leasing system into the 21st century,” the letter continues. The reconciliation package passed in August by congressional Democrats “raised the onshore oil and gas royalty rate, rental rates, and minimum bid for the next 10 years and eliminated noncompetitive oil and gas leasing, but the Department of the Interior (DOI) must take further steps to solidify and build upon these initial reforms.”

To begin with, the letter states, the Interior Department’s BLM “must reform bonding through the rulemaking process to protect taxpayers from future liabilities and ensure we get a fair return for publicly owned natural resources.”

As the coalition explained:

Oil and natural gas companies drilling on federal land are required to plug (reclaim) their wells and clean up the surrounding sites after production ends. Wells that are not completely reclaimed in a timely manner pose serious environmental, safety, and public health threats, which disproportionately impact low-income communities of color. To guarantee the cleanup of these potentially hazardous and environmentally harmful sites, producers are required to post a bond before they start drilling. If the company abandons its wells on a federal lease, or goes bankrupt, the bond is used to cover the reclamation expenses. But for leases on federal land, the required bond minimums have not been updated in 60 years and do not cover the full cost of cleanup, which means taxpayers must cover these costs. According to the Government Accountability Office, the average value of bonds held by the Bureau of Land Management in 2019 was only $2,122 per well whereas well reclamation costs can range from $20,000 per well to $145,000 per well. In fact, 84% of bonds, which cover 99.5% of wells on federal lands, are not enough to cover even the lower estimate of $20,000 per well. Egregiously low bond minimums incentivize operators not to reclaim wells since it is often more costly to reclaim their wells than to simply forfeit the minimum bonded amount.

Updating decades-old policies to ensure that the average value of bonds held by BLM is not 10 to 70 times lower than standard well reclamation costs would “protect taxpayers from the financial, environmental, and public health costs caused by abandoned wells on federal land,” the letter notes. “Plugging and cleaning up existing producible oil and gas wells on public lands could cost more than $6 billion, and it is crucial that the burden not fall on taxpayers, given that taxpayers have already committed $250 million appropriated by the Infrastructure Investment and Jobs Act.”

DOI has so far announced plans for three new oil and gas lease sales in 2023. The first will offer more than 261,200 acres of public land in Kansas, Nebraska, New Mexico, and Wyoming to the highest-bidding drillers. The second and third will put a total of 95,411 acres of public land in Nevada and Utah on the auction block.

“Bonding rates haven’t changed since the 1960s and federal royalty rates are less than what states charge.”

These upcoming sales are slated to use the new minimum onshore royalty rate of 16.67% established by the IRA even though BLM in June held an oil and gas lease auction that used an 18.75% royalty rate. “Although 16.67% is an improvement compared to the outdated rate of 12.5% taxpayers were stuck with for over a century, it still lags what states like Texas, Colorado, New Mexico, and Louisiana charge for oil and gas production on state lands,” the letter points out. “To prevent potential royalty losses and to give taxpayers a fair return on the resources we all own, DOI must take further steps to solidify the 18.75% rate in a formal rulemaking.”

A recent Public Citizen report found that U.S. taxpayers lost up to $13.1 billion in revenue over the past decade due to artificially low royalty rates.

The coalition welcomed BLM’s recently issued guidance outlining how future fossil fuel lease sale parcels will be evaluated based on preference criteria including proximity to existing extraction; presence of key fish and wildlife habitats, historical or cultural sites, and recreation; and potential for development. This “will help curtail speculative leasing, which allows oil and gas companies to lock up federal lands from other important uses,” wrote the groups. DOI should “take further action to codify this preference criteria for evaluating parcels, especially the potential for development, in federal regulations.”

“With new lease sales around the corner, time is of the essence,” the letter adds. “Continuing forward with onshore oil and gas lease sales without implementing needed reforms will lock the federal government into bad deals that continue to shortchange taxpayers. The federal onshore oil and gas leasing system is failing taxpayers, and every new lease signed under these terms is a loss.”

Autumn Hanna, vice president of Taxpayers for Common Sense, stressed that “the federal oil and gas leasing system is broken.”

“Important reforms were included in the Inflation Reduction Act, but more must be done,” said Hanna. “Bonding rates haven’t changed since the 1960s and federal royalty rates are less than what states charge. The Department of the Interior must take steps—through a formal rulemaking—to reform these outdated policies.”

“Fighting climate change means no new fossil fuel leases. Not now, not ever.”

When DOI, in a report released last November, proposed adjusting royalty rates and bond minimums and prioritizing lease sales in high-potential areas that don’t conflict with other important uses, climate justice campaigners responded critically.

“These trivial changes are nearly meaningless in the midst of this climate emergency, and they break Biden’s campaign promise to stop new oil and gas leasing on public lands,” Randi Spivak, public lands director at the Center for Biological Diversity, said at the time. “Greenlighting more fossil fuel extraction, then pretending it’s OK by nudging up royalty rates, is like rearranging deck chairs on the Titanic.”

According to the Center for Biological Diversity, “Federal fossil fuels that have not been leased to industry contain up to 450 billion tons of potential climate pollution; those already leased to industry contain up to 43 billion tons.”

The U.S. Geological Survey has estimated that roughly 25% of the nation’s total carbon dioxide emissions and 7% of its overall methane emissions can be attributed to fossil fuel extraction on public lands and waters, and peer-reviewed research has estimated that a nationwide prohibition on federal oil and gas leasing would slash carbon dioxide emissions by 280 million tons per year.

“President Biden and Secretary Haaland still have the tools to uphold their commitments to monumental climate action, and that can start right now with banning new fossil fuel leasing, invalidating recent sales, canceling upcoming sales, and issuing a five-year plan with no new offshore leases,” Rep. Rashida Tlaib (D-Mich.) said earlier this year. “Nothing less than a livable planet is on the line.”

“Fighting climate change means no new fossil fuel leases,” Tlaib added. “Not now, not ever.”