Faster, cheaper, and more transparent cross-border payment services have the potential to improve many lives by supporting economic growth, international trade, global development, and financial inclusion. The Group of Twenty has prioritized such progress.

That’s because the financial links between countries, particularly between emerging market and developing economies, face several challenges that must be addressed, including high costs and inconsistent charges depending on the countries being linked, as we explore in a new paper prepared as part of our payments work with the G20.

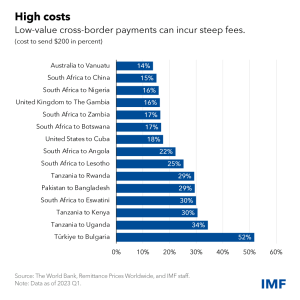

The global average cost of sending $200 from one country to another is about $12.50 in the first quarter of 2023, or 6.25 percent, according to the World Bank’s Remittance Prices Worldwide database. The G20 have set a target, reaffirming the United Nations Sustainable Development Goal, of a global average cost for sending a $200 remittance of no more than 3 percent by 2030, with no corridors higher than 5 percent.

However, as the Chart of the Week shows, some costs are many times higher than this target. Fees exceed 50 percent for funds sent from Türkiye to neighboring Bulgaria, for example. Costs are notably high for sending money in sub-Saharan Africa, where Tanzanian remittances to Uganda and Kenya incur fees over 30 percent. In South Africa, it’s particularly costly to send across its borders with Botswana, Eswatini, and Lesotho.

High fees, especially bank-to-bank transfers, are a main driver of the high costs for corridors between emerging market and developing economies. Such bank fees tend to be much lower for transfers originating in advanced economies where foreign-exchange margins can be 50 percent or more of the cost in some corridors.

The Financial Stability Board acknowledged in a recent report that progress under the roadmap to enhance cross-border payments will be needed to meet the targets set across the wholesale, retail, and remittances market segments.

To help reduce costs and address challenges with cross-border payments, international organizations such as the IMF and World Bank will need to play a key role by sharing best practices through technical assistance for member countries. Technical assistance can help because, while the targets are set at a global level, they require coordinated and customized assistance at the country level to address specific challenges.

The IMF shares its knowledge with government institutions such as finance ministries and central banks through hands-on advice, training, and peer-to-peer learning. Our technical assistance is part of capacity development, which is a core mandate that accounts for nearly a third of the IMF budget.

We will focus in coming years on improving access to payment systems, extending and aligning operating hours, interlinking of payment systems, combating money laundering and the financing of terrorism, and harmonizing payment systems by adopting the global and open standard for exchanging financial information, known as ISO 20022. We will also collaborate with the World Bank at the country and project level.

IMF Blog